Market Update

Crude Oil

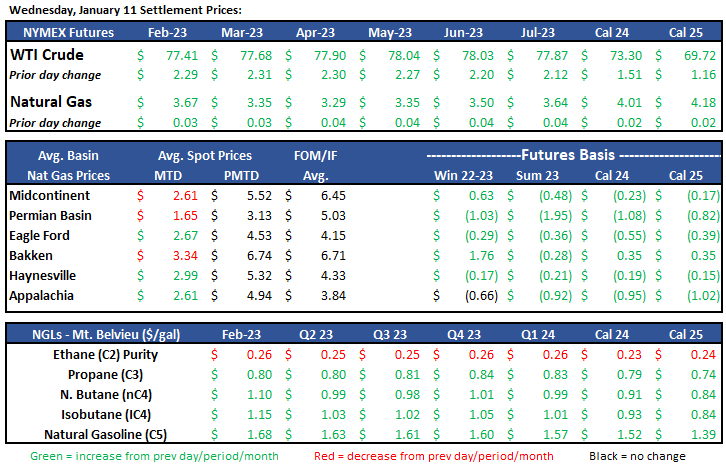

At the time of the report WTI is trading at $78.75/bbl, 6% higher than last Thursday. This weeks EIA report showed production flat but a large increase in storage.

After the 221 mm bbl SPR release in 2022, the DOE stated they would refill the SPR for $67-70 per bbl. However, the SPR might not be refilled. The DOE sought to buy 3 mm bbls, and the processes failed. They stated, “DOE will only select bids that meet the required crude specifications and that are at a price that is a good deal for taxpayers.” Many believe they cannot afford to buy at today’s market rate.

December production from OPEC+ shows an increase in production month over month, but they are still not meeting the previously announced production quotas. Shockingly, Nigeria announced the discovery of an illegal underwater 2.5 mile pipeline theft operation that has been operating for 9 years.

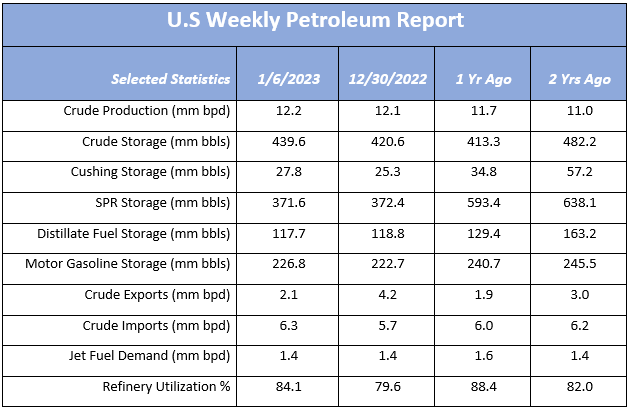

The EIA Petroleum Status Report for the week ending January 6th, 2023 was released on today, production had a minor increase from the prior week at 12.2mm bbls. Crude storage had large increase to 439.6mm bbls. Refinery run rates remain low at 84.1%. Jet fuel supplied remained the same as the prior week at 1.4mm bpd.

www.eia.gov/petroleum/supply/weekly

Rig Count Update:

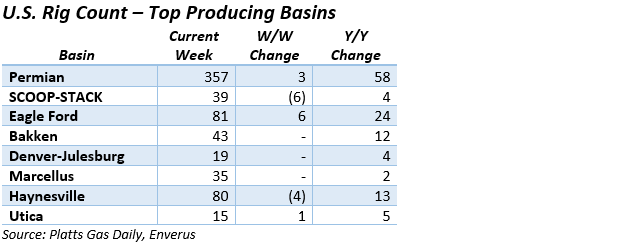

The U.S. O&G rig count continues to drop, posting a loss of seven rigs to 862 and making it the 4th straight week of losses. The SCOOP-STACK was the biggest loser, losing six rigs and now sits at 39, the lowest level since mid-August. The Haynesville wasn’t far behind, shedding 4 while the Eagle Ford offset the losses by picking up six. With the solid gain on the week, the play is now 24 rigs higher than same time last year. The Permian added three to 357 and sits 58 rigs higher than a year ago. Despite the recent declines, analysts are still expecting the overall count to increase “slightly” in 2023.

Natural Gas

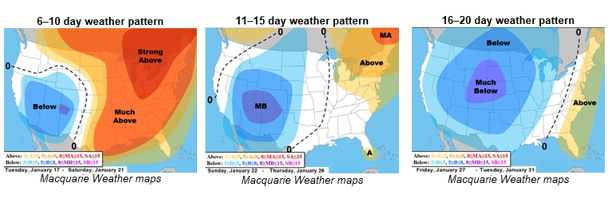

After opening the week on an uptick, Natural Gas futures have trended down most of the week. Demand and weather have continued to hold prices down. Long term weather forecasts remain above average which has wintertime demand a no-show. Add in catastrophic flooding and mudslides in California, west coast demand looks to be further hindered. In LNG news, the Freeport LNG facility outage remains a large part of the global picture. Going on a seven-month outage, regulatory approvals are still pending, and expectations of a January re-start are now out of sight. With Europe continuing to rebuild its gas storage, the facility opening could have a huge impact on easing the squeeze of global LNG supplies. With the natural gas rig count seeing its lowest count in 3 months and a good portion winter yet in front of us, look for any cold snaps to have a positive impact on prices.

In the Midcon region, spot prices have decreased with demand moving down for the fourth straight day. With Chicago city-gates landing in the $3.15 range, demand was expected to decline by more than 600 MMcf/d. Residential-commercial demand is responsible for over 500 MMcf/d of the drop, according to S&P Global Commodity Insights. Midcon supply also fell over 1% with daily inflows coming in at 12.3 Bcf/d. In the forward market, Chicago city-gates climbed to $1.35 premium above Henry Hub with ANR-OK -$.26 back and NGPL-Midcon coming in -$.48 back.

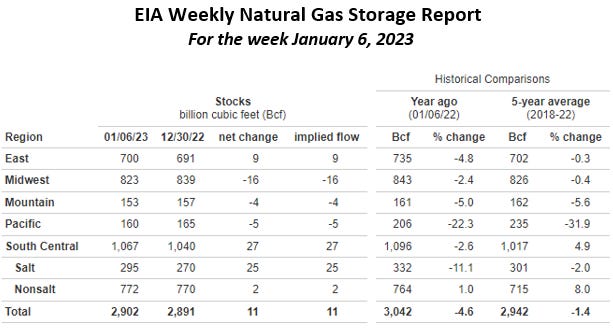

The EIA released storage numbers this morning, coming in at 2,902 Bcf, representing a net +11 Bcf increase from the previous week. This increase was slightly more than marketplace expectations of 0 to -2 Bcf decrease. Stocks were 140 Bcf more this time last year and come in 40 Bcf below the 5 yr. historical range of 2,942 Bcf.

Natural Gas Liquids (NGLs)

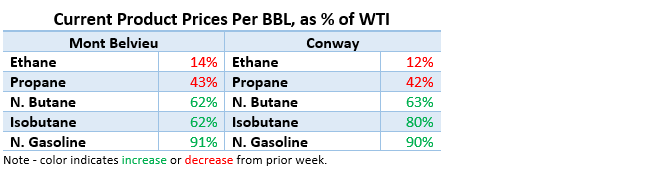

All product prices are higher from same period last week, with exception of Ethane in both Mont Belvieu and Conway (down 10% and 13%, respectively). Normal Butanes were both higher by double digits, along with MB Natural Gasolines on the back of the recent crude rebound. Propanes increased by ~5% while the remaining products were all just shy of gaining double digits.

ANCOVA DISCLAIMER: The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.