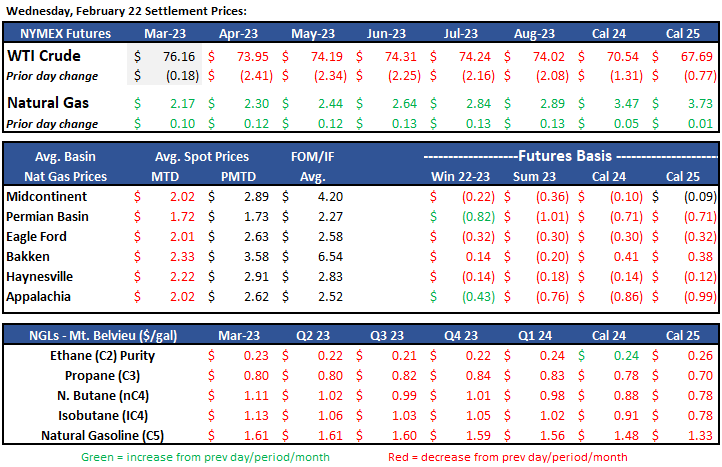

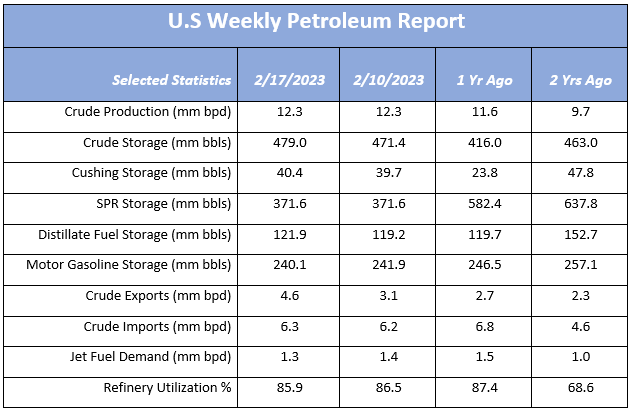

Crude Oil

Prompt-month WTI is currently trading at $75.87/bbl (+$1.68), reversing about half of yesterday’s loss, stemming from the API’s report of a 9.8mm bbl storage build. EIA released the more reliable numbers this morning reporting a lesser 7.6mm bbl increase, only 0.7mm of that coming from Cushing. Much of the recent U.S. storage build can be attributed to steady releases of the SPR which predominantly affects the Gulf Coast region, along with forecasted seasonal refinery maintenance. Look to see storage numbers come down in very near future, but if not, the recent dip in price makes sense and U.S. demand is softer than what the “experts” are forecasting. The March 2023 contract went off the board at $76.16.

www.eia.gov/petroleum/supply/weekly

Some bullish news this week from Bloomberg. The largest oil trader in China, Unipec and its state-held refiner Sinopec, along with PetroChina, the largest oil producer in China, have both hired ten supertankers to haul U.S. crude back to Asia. Each tanker is capable of transporting 20mm bbls. “Chinese buying activity of US barrels seems to be the hottest activity right now,” a lead crude analyst at Kpler told Blumberg. Apparently Chinese firms are taking advantage of a remarkable and profitable arbitrage for U.S. crude due to Pres Biden’s massive Strategic Petroleum Reserve releases. China’s oil demand is finally rebounding after it has shelved its “zero Covid” policies.

“China will drive nearly half of this global demand growth even as the shape and speed of its reopening remains uncertain,” International Energy Agency said last month.

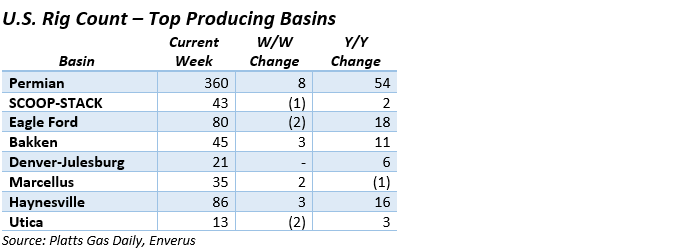

Rig Count Update:

The US rig count added 14 on the week with the Permian leading the way with eight, now up to 360 active rigs in the basin. Overall, the average rig count (861) in Feb 2023 is off its peak of 889 in Nov 2022, primarily due to weakening nat gas prices which has caused several drillers to move from gas plays to oiler markets. 2023 modest budgets across the industry will likely grow the overall rig count throughout the year but at a slower rate than experts were forecasting late last year.

Natural Gas

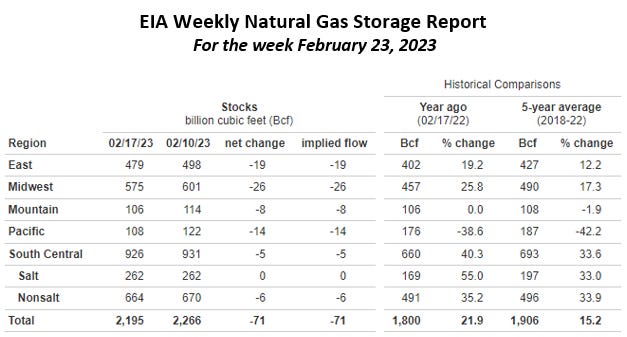

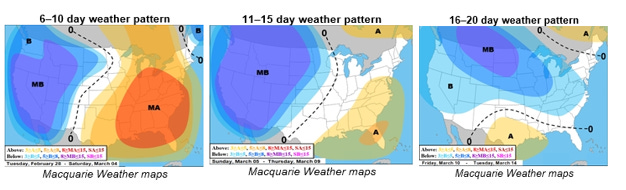

An over-supplied market driven by warmer than normal temps continue to be the story as Natural Gas prices have been kept at bay this week. After opening the holiday week at $2.22, prices fell below the $2 mark on Wednesday for the first time since September 2020. Forecasts for milder weather and lower heating demand have natural gas production exceeding demand as the winter season begins to wrap up. On a more positive note, Freeport LNG announced Tuesday that regulators have approved the restart of their commercial operations for two of the three liquefaction trains. An increase in LNG export capacity looks to provide balance to a market that has pushed inventories to record levels as production has continued to grow above seasonal norms.

In the Midcon region, spot natural gas prices were on the rise mid-week as temps in the region were forecasted to decrease by week’s end. With temps in the region forecasted to fall 7 degrees below normal, Chicago city-gate increased $.05 to $2.20/MMBtu while ANR-OK came in at $2.29. In the forwards market, Chicago city-gates comes in at a $.05 premium to Henry Hub at $2.23 while ANR-OK and NGPL Midcontinent are sitting at $2.12 and $1.93 respectively. With the temperature drop total demand was expected to increase 3.1 Bcf/d up to 24.1 Bcf/d according to S&P Global Commodity Insights. Residential-commercial demand is responsible for 1.6 Bcf/d of the increase while power demand was projected to double to 825 MMcf/d.

The EIA released storage numbers this morning, coming in at 2,195 Bcf, representing a net -71 Bcf decrease from the previous week. This decrease was slightly more than marketplace expectations of – 65 Bcf decrease. Stocks were 395 Bcf less this time last year and come in 289 Bcf above the 5 yr. historical range of 1,906 Bcf.

Natural Gas Liquids (NGLs)

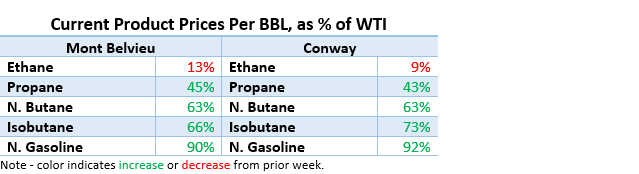

Prompt-month liquid prices were mixed across both Mont Belvieu and Conway compared to same period last week. Propanes were basically flat in both markets, N. Butanes and Isobutanes on average were ~ 3% higher, while N. Gasolines were both 2% lower. MB Purity Ethane was 7% lower; Conway Ethane was down 6% WoW. With exception of Ethane, all products as a % of WTI are higher given the softening of NYMEX crude this week.

ANCOVA DISCLAIMER: The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.