Crude Oil

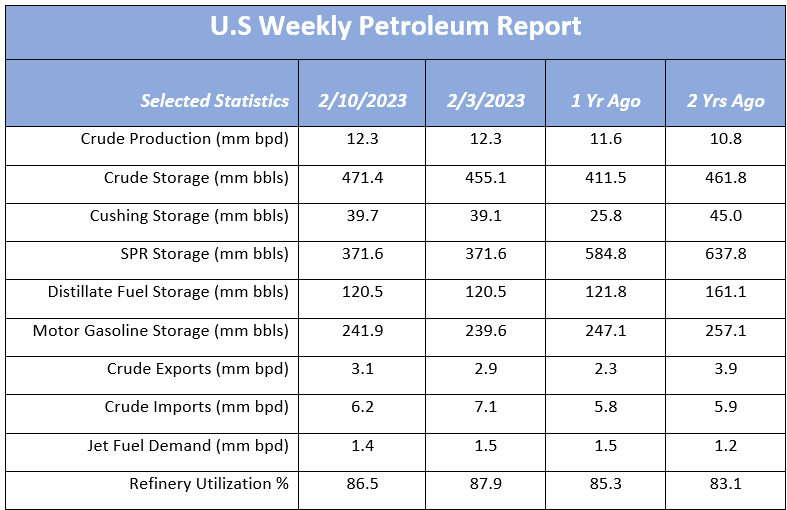

The front month contract has traded in a fairly tight range throughout the week - opening at $79.94, trading as high as $80.62 but has settled in around the $78/bbl mark as the scheduled (unexpected) oil release from the Strategic Petroleum Reserve put a halt on the rally from the week before, not to mention a very large storage build of 16.3mm bbls which was nowhere near expectations. Some of this build is said to be noise from data adjustments and not an actual accumulation of storage. The Gulf Coast saw the bulk of the build while Cushing only showed a 600k barrel increase. Bullish crude factors include overall world demand picking up as OPEC estimates transport fuel consumption to rise 1.1mm bpd year on year. Also this week the International Energy Agency forecasted oil demand this year would hit a record high of 101.9mm bpd, an uptick of 2.0mm bpd from last year.

www.eia.gov/petroleum/supply/weekly

Natural Gas

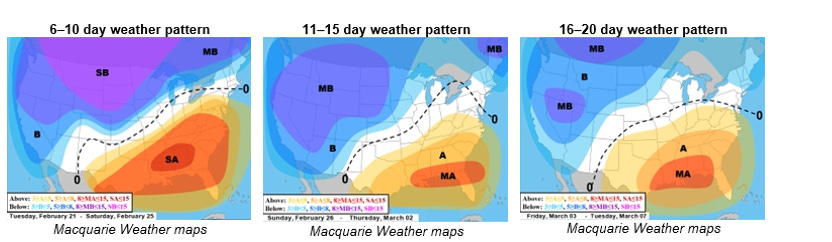

Natural Gas futures bounced around the $2.60 range this week with temps turning a bit colder and talks of the Freeport LNG facility start date getting closer. While analysts do not expect the LNG facility to be at full capacity for months down the road, news that Freeport had restarted one of its three liquefaction trains was welcomed on Monday. Pipeline flows to the plant increased this week to the highest levels since the 6/22 plant shut down. While demand is still lagging nearly 22% below last year’s levels, news of a possible demand rebuild has traders excited. With not much changing on the longer-term weather forecasts, the warmer than normal temps look to keep the bearish pressure on prices for now.

In the Midcon region, expectations of a demand surge have spot natural gas prices on the increase. ANR-OK comes in at $2.37 and NGPL Midcontinent at $2.28. In the forwards market, Chicago city-gates comes in $.09 off Henry Hub at $2.38 while ANR-OK and NGPL Midcontinent are sitting at $2.42 and $2.17 respectively. Total demand was expected to increase as much as 6.7 Bcf/d up to 25.2 Bcf/d according to S&P Global Commodity Insights. Residential demand is responsible for most of the increase, with expectations of a 4.1 Bcf/d increase as temps were forecasted to be near normal after coming in nearly 13 degrees above normal earlier in the week. Midcontinent supply looks to decrease to 21.1 Bcf/d, 1% lower than this time last year.

The EIA released storage numbers this morning, coming in at 2,266 Bcf, representing a net -100 Bcf decrease from the previous week. This decrease was slightly less than marketplace expectations of – 155 Bcf decrease. Stocks were 328 Bcf less this time last year and come in 183 Bcf above the 5 yr. historical range of 2,083 Bcf.

Natural Gas Liquids (NGLs)

All products in both Mont Belvieu and Conway were lower on the week with exception of MB N. Gasoline, barely higher at 1%. Biggest loser this week was in Conway with N. Butanes falling 12%.

ANCOVA DISCLAIMER: The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.