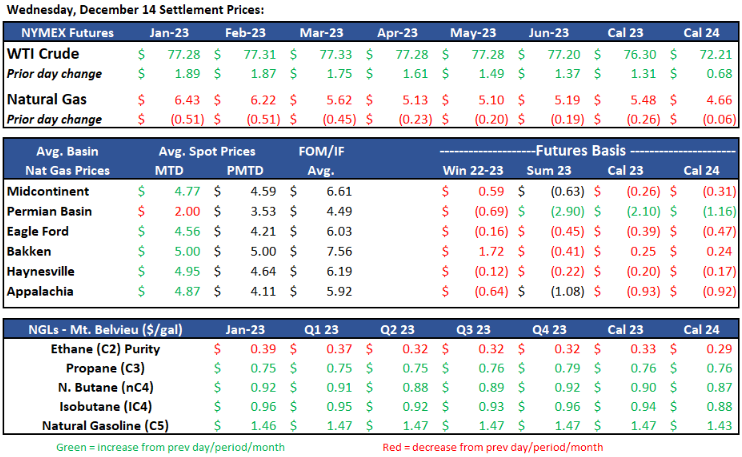

Crude Oil

At the time of the report WTI is trading at $76.47/bbl, which is slightly down from earlier in the week upon EIA weekly data reflecting 10.2mm bbl of crude storage build.

The Keystone Pipeline was shut-in last week due to a leak. Since then, they have restarted a portion of the line that was unaffected. The Keystone Pipeline imports 600,000 bpd of crude from Canada to the U.S.

OPEC+ announced last week that the production quotas will remain the same, 2mm bpd lower than October.

The European Union passed the Russian crude price cap at $60/bbl and was implemented December 5th. However, many Asian importers have not implemented the price cap and have continued buying ~3mm bopd of Russian crude. On a related note, to avoid the caps many crude tankers that were previously registered in Russia, have now changed ownership to other countries, including Dubai. These “Dark Ships” along with others are now shipping Russian crude along with previously sanctioned Venezuelan and Iranian crude.

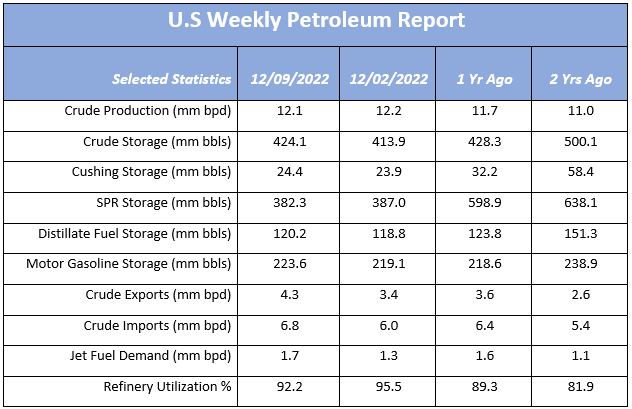

The EIA Petroleum Status Report for the week ending December 9th, 2022 was released on Wednesday, production had a minor decrease down to 12.1mm bbls. Crude storage reversed the previous weeks of draws and increased to 424.1 mm bbls, which was a 10.2 mm bbl increase from the prior week. U.S. Crude inventories are 6% below the five year average. Refinery run rates are still running high but has a decrease running at 92.2% utilization. Jet fuel supplied was had a large jump from the previous weeks to 1.7 mm bpd.

www.eia.gov/petroleum/supply/weekly

Rig Count Update:

The U.S. O&G rig count dropped four on the week to 876, with numerous basins shedding rigs as we approach the holiday season and year end. The Haynesville and Eagle Ford bucked the trend, gaining four and three rigs, respectively. The Permian dropped a couple rigs while the SCOOP+STACK combined play kept flat at 48. Reed Olmstead, an S&P Global upstream analyst, expects rig counts to mildly drop over the coming year. “Not in a big way, but our belief is that we’ve seen horizontal activity ‘peak’ for a bit.”

Natural Gas

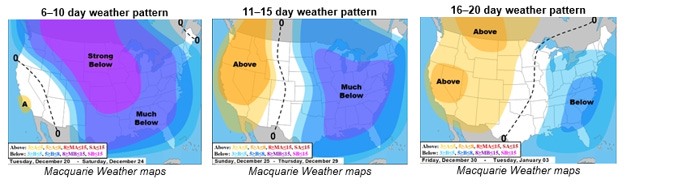

After topping the $7 mark early this week, Natural Gas futures have remained in the high $6 range. Colder weather has factored in and kept trading steady. If the long-range weather models hold true with Artic cold pushing in, single digit windchills should prompt a much-needed bump in demand. Freeport’s LNG facility remains a hot topic as the latest headlines indicate regulatory action is needed before resuming operations. Freeport is the second-largest US exporter and processes ~ 2 bcfd of gas into LNG. Since the plant fire back in June, gas intended for the facility remains in the domestic market and has weighed heavy on prices. With the unrest in Europe over energy supplies, look for the severity of winter to put further pressure on the US export market.

In the Midcon, prices took a mid-week bump as demand was forecasted to increase as temps were expected to drop a few degrees below normal, all while production in the region moved lower. With demand expectations over 22 Bcfd, net flows into the Midcon market were down over 770 MMcf according to S&P Global Commodity Insights. The welcoming demand bump has prices on the uptick as Chicago city-gates comes in a $.89 discount to Henry Hub, while ANR-OK is $.94 off at $5.66 and NGPL-Midcon is $1.18 back at $5.42.

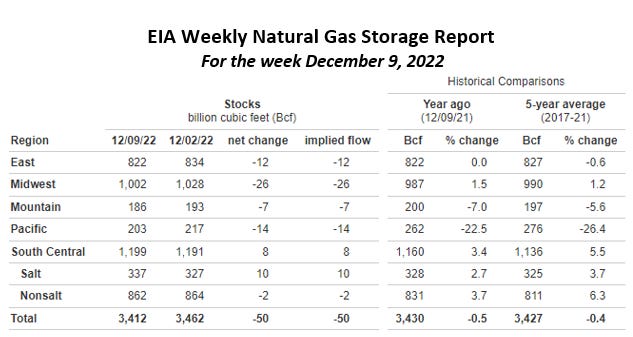

The EIA released storage numbers this morning, coming in at 3,412 Bcf, representing a net -50 Bcf decrease from the previous week. This decrease was slightly less than marketplace expectations of -59. Stocks were 18 Bcf more this time last year, however, this week’s levels are still within the 5 yr. historical range of 3,427 Bcf.

Natural Gas Liquids (NGLs)

Majority of product prices in Mont Belvieu and Conway rebounded from the blood bath earlier in the month. Ethane in Conway led the way with an 18% w/w bump, following by MB purity Ethane at 13%. All other prices stayed in that 2-6% gain, with the exception of Isobutane (2% drop). Despite the weekly gains, most product prices as a % of WTI dropped, as crude saw a 7-8% increase w/w.

ANCOVA DISCLAIMER: The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.