Crude Oil

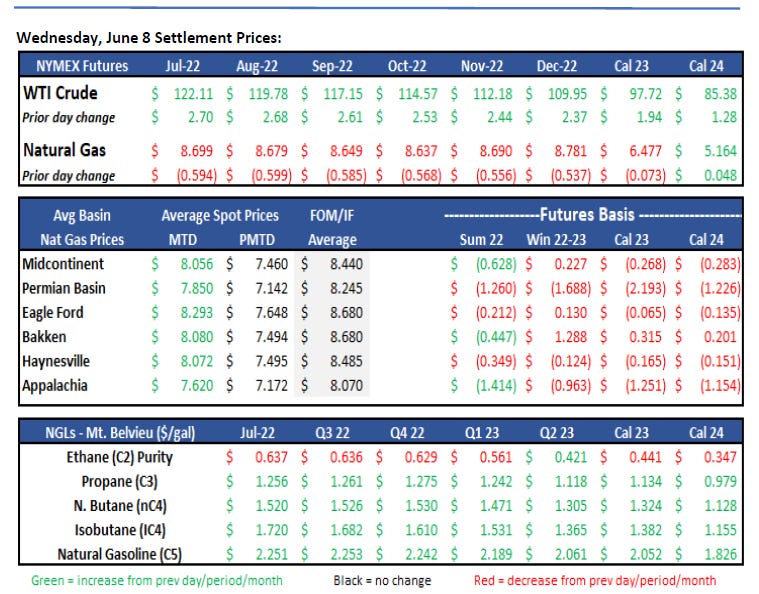

At the time of the newsletter, WTI was trading at $121.70/bbl. Although there was a small crude inventory build and crude production remained flat, WTI continues to rise.

The Strategic Petroleum Reserves (SPR) fell to 538mm bbls, the lowest level since 1987. The oil released from the US SPR is similar quality to Canadian Crude that is shipped down to the Gulf. Western Canadian Select (WCS) is trading $20 below WTI, which is the largest discount in several years. However, out months only show a $3 discount on WCS compared to WTI.

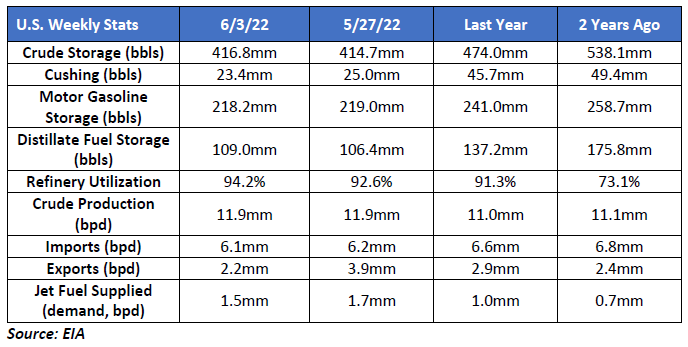

At 94.2% utilization rate the past week, refineries continue to operate at near maximum utilization rates. Hurricane season starts next month and is particularly worrisome this year due to low inventories and possibility of refinery and platform shut-downs due to weather. Meanwhile, U.S. export are at all time highs and demand is expected to continue to increase.

OPEC+ is 2.6mm bbls behind the most recent output projections. OPEC+ announced plans to add 650mm bpd for July and August. The added output would replace Russian oil that is no longer on the market.

The EIA Petroleum Status Report for the week ending June 3rd, 2022 reversed the previous weeks of inventory draws and had week of crude inventory build. At 416.8mm bbls, crude inventories remain 15% lower than the five year average. Domestic crude production remained flat for the fourth week at 11.9mm bbls. Refinery run rates increased this week and continue to near max rates at 94.2% utilization. Jet fuel supplied decreased to 1.5mm bbls, and is up 26% compared to this time last year.

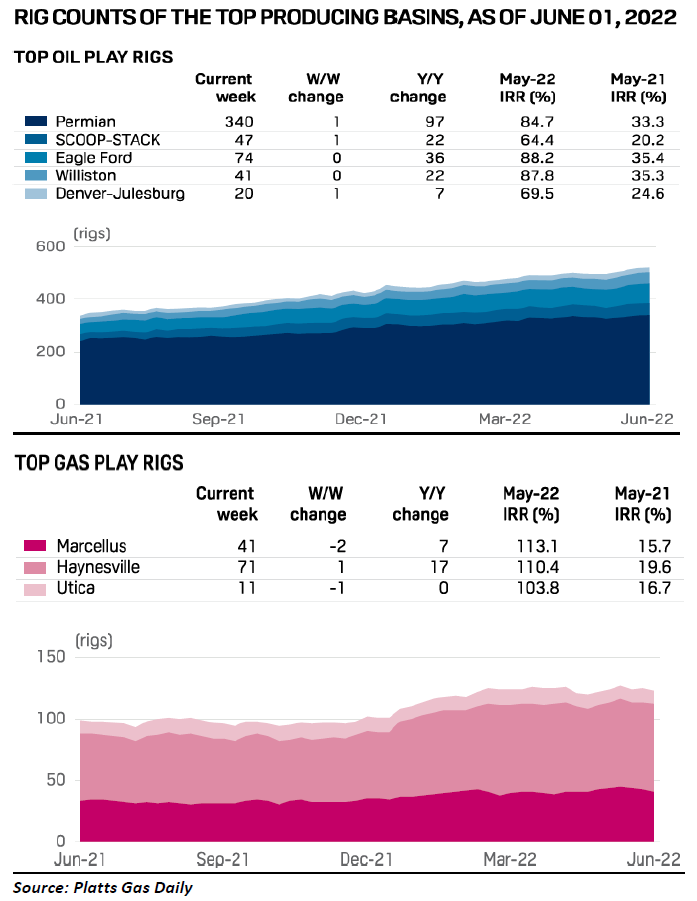

Rig Count Update:

The US oil and gas rig added another three last week to 821 as totals continue to approach pre-pandemic counts. Oil rigs actually lost three rigs, down to 640, but the overall total was offset by six new gas rigs for a total of 181. The major basins were quiet, with Permian, SCOOP+STACK, and DJ all adding a lone rig. Eagle Ford and Bakken stayed flat.

Natural Gas

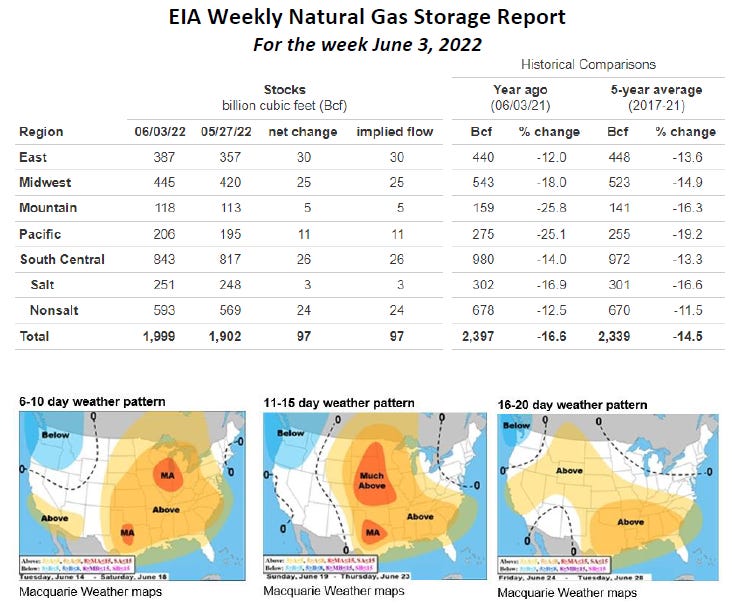

After opening the week at $8.75, Natural Gas futures have continued to trade well above the $9.00 mark for most of the week, nearly tripling what we saw in January. This morning’s trading has seen prices fall back into mid-$8 range triggered by a disruption at an LNG terminal in Texas. With production being diverted away from the facility coupled with an unknown repair timeline, this appears to be a near term price driver. Early summer heat has a heavy demand pull for most of the Midwest and southeast this week and looks to support the near-term bullish trend for prices.

Midcon natural gas prices rose as much $0.20 yesterday. ANR-OK prices are sitting just below the $9 mark at $8.95 while NGPL-Midcon is close behind at $8.85. With demand in the region still above last week’s totals, month-to date averages look to remain above the 2021 totals for this time last year. Storage totals in the Midcon region are still below 2021 levels and are sitting 8.5 Bcf below the five-year average according to S&P Global data. Heading into the next 7-10 days, residential demand looks to fall while power demand is projected to rise slightly.

As mentioned, one of the largest US LNG export plants is facing a setback after an incident at its Gulf Coast facility. Freeport LNG announced on Wednesday that it will shut down the facility for at least three weeks after suffering an explosion. The plant which processes up to 2.1 (Bcfd) of natural gas and 15 (MTPA) of liquid gas provides about 20% of US LNG processing the United States. As a result, European gas prices are on the rise as traders fear this setback will only add to an already stressed market due to reduced Russian supplies.

The EIA released storage numbers this morning, coming in at 1,999 Bcf, representing a net +97 Bcf increase from the previous week. This increase was slightly below marketplace expectations +101. Stocks were 398 Bcf higher this time last year, however, this week’s levels are still within the 5 yr. historical range of 2,339 Bcf.

Natural Gas Liquids (NGLs)

Product prices across both Mont Belvieu and Conway were mixed on the week. Both Ethane products were 5% higher, along with Conway N. Gasoline. Iso Butane at Conway was the biggest loser, dropping 9%.

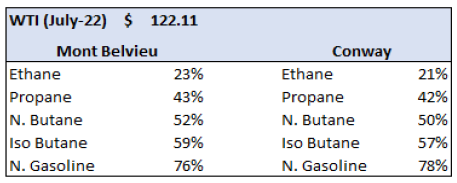

Current product prices (% of WTI):

Per yesterday’s EIA Weekly report for week ended 6/3/2022, U.S. propane stocks rose for the fourth consecutive week, adding 0.6mm bbls to 50.2mm, compared to 53.7mm a year ago. US Propane demand shot up on the week to 1.37mm bpd from 0.62mm. Propane production remained flat on the week at 2.4mm bpd.