Happy Friday! Note - the writing staff at Ancova will be out on Spring Break so unfortunately there will not be a Markets Update report next week.

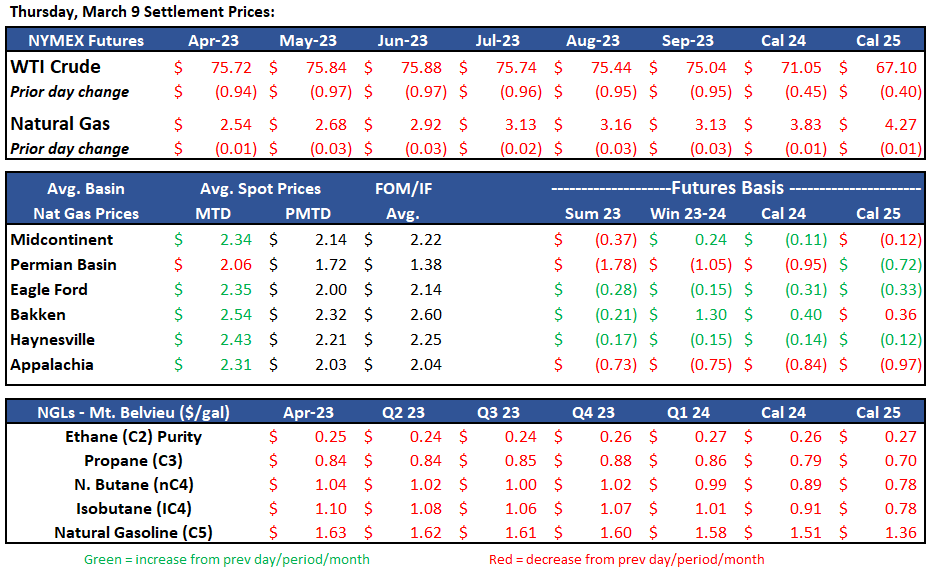

Current Market Pricing

Crude Oil

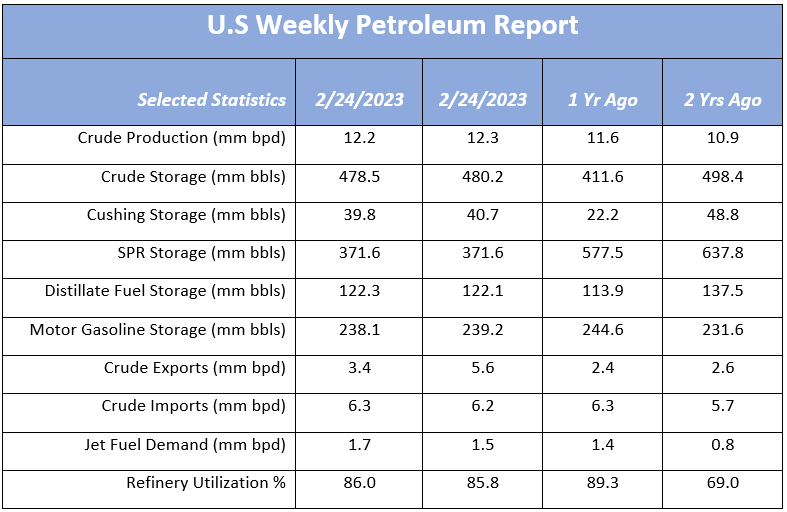

The prompt month WTI contract closed $0.94 lower yesterday to $75.72, making it the third straight day it has posted losses. Early in this morning’s trading, crude is up over a buck at $76.91. Depending on how the balance of today’s session shakes out, it’s on track to be the largest weekly decline since early January after the head of the Federal Reserve reignited recession fears. The prospect of faster and higher rate hikes has certainly put a bearish sentiment on demand.

President Biden’s advisors are expected to propose a budget that will do away with oil and gas subsidies worth “tens of billions of dollars”, including drilling incentives. A divided Congress however kills any real chance of it getting passed. On the flip side, the House Energy and Commerce Committee led by Republicans approved a dozen or so bills yesterday covering O&G export issues, natural gas pipeline application reviews, and other pro Energy measures. Democrats quickly asserted that it’ll go nowhere in the Senate.

Other news out of Washington this week - a group of nonpartisan senators have reintroduced legislation aimed at halting OPEC’s anti-competitive behavior of collaborative production cuts. The No Oil Producing and Exporting Cartels, or NOPEC, was reintroduced by Chuck Grassley (R) and Amy Klobuchar (D). If passed by the committee, both chambers of Congress, and signed by the President, the bill would change U.S. anti-trust law to revoke the sovereign immunity that has protected OPEC+ members and their state-sponsored oil companies from price collusion lawsuits.

U.S. Rig Count Update

Not much movement for the major basins, with the exception of the Eagle Ford, which lost roughly 13% of its overall rig count. Per Baker Hughes, the overall total sat at 749 (732 land, 17 water) for the first week of March, dropping a net four from previous week but 99 higher than a year ago.

Source: Platts Gas Daily

Natural Gas

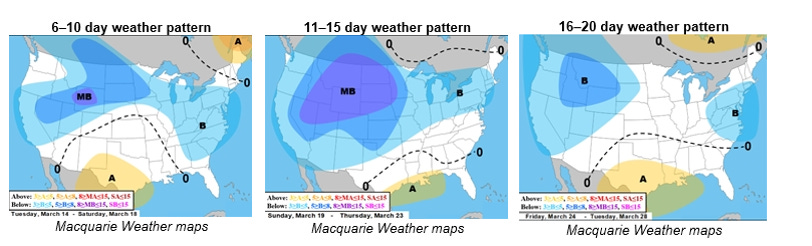

After ending last week on a rally, Natural Gas futures took a tumble to start the week, closing at $2.57 on Monday, accounting for the largest drop since January, as they dropped 12.3%. The prompt month contract is lower again today, trading ~$2.47 at the time of publication. Mild weather and lower demand continue to be the story this week. Even with a few extreme weather events that have reduced gas production output, nothing has been sustainable. The forecast looks to be less severe than originally anticipated during last week’s rally. The drop in prices comes on the heels of an increase in LNG exports. Freeport’s facility is scheduled to increase flows yet again as regulators approved the restart of the third train this week. With a capacity of 2.1 Bcf/d, Freeport is the second-largest US LNG export plant and running at full capacity should push the US LNG exports past the 12.9 Bcf/d monthly record set in 3/22.

In the Midcon region, spot natural gas prices fell across the board even with a forecasted increase in demand. Chicago city-gate fell by $.05 to $2.50/MMBtu with ANR-OK down to $2.43, ONEOK at $2.21 and Panhandle at $2.18. In the forwards market, same story as NGPL fell to $.26 below Henry Hub and ANR OK was $.14 back at $2.41/MMBtu. With temps forecasted to be in the upper 30’s for most of the region and demand expected to increase to 21.9 Bcf/d according to S&P Global Commodity Insights, it will be a continued wait and see approach for prices.

The EIA released storage numbers this morning, coming in at 2,030 Bcf, representing a net -84 Bcf decrease from the previous week. This decrease was slightly more than marketplace expectations of – 91 Bcf decrease. Stocks were 493 Bcf less this time last year and come in 359 Bcf above the 5 yr. historical range of 1,671 Bcf.

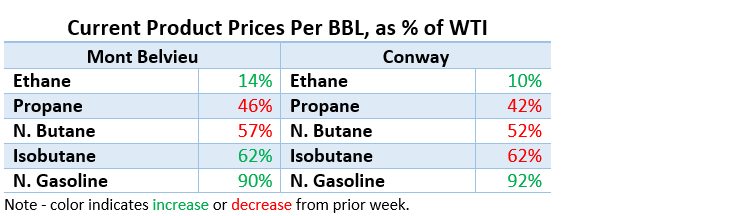

Natural Gas Liquids (NGLs)

Product prices across the board were lower in both markets, with exception on Conway N. Gasolines which stayed flat on the week. Biggest losers were at Conway, with N. Butane and Isobutane down 12% and 11%, respectively.

ANCOVA DISCLAIMER: The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.