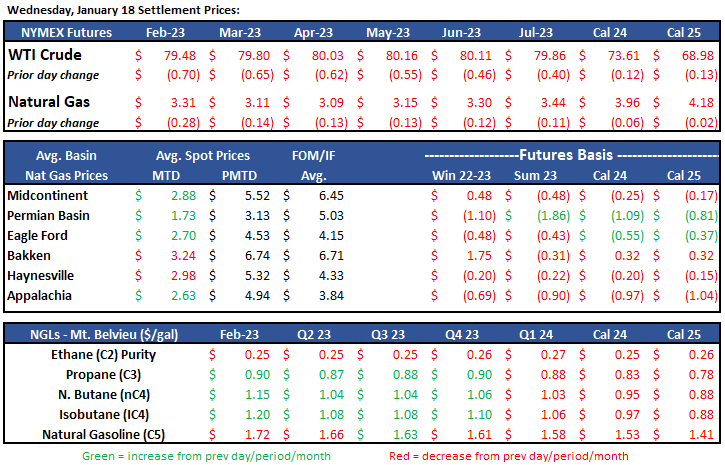

Pricing

Crude Oil

At the time of the report WTI is trading at $80.53/bbl, 2% higher than last Thursday. This weeks EIA report mirrored the previous week with production remaining flat but another large increase in storage.

With increased demand coming from China, Japan and India, world crude demand hit a 9 month high at 1.7 million bopd. November global demand matched pre Covid demand, while November global production is ~3% below pre Covid.

Russia is finally feeling the pain of the $60/bbl price cap that the EU implemented in December. Russia’s energy revenues have fallen and are expected to continue to fall as other countries source crude elsewhere. Russia has responded by placing a five month crude purchase ban on countries that abide by the price cap. Currently there are discussions to lower the Russia price cap, add refined products price caps, and sanction nuclear.

After the 221 mm bbl SPR release in 2022, the DOE stated they would refill the SPR for $67-70 per bbl. However, the SPR might not be refilled. The DOE sought to buy 3 mm bbls, and the processes failed. They stated, “DOE will only select bids that meet the required crude specifications and that are at a price that is a good deal for taxpayers.” Many believe they cannot afford to buy at today’s market rate.

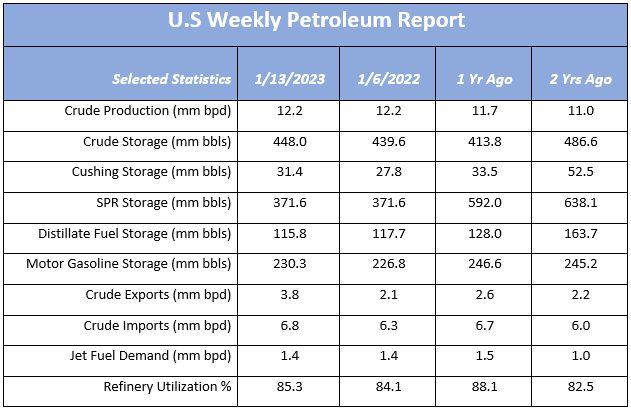

The EIA Petroleum Status Report for the week ending January 13th, 2023 was released on today, production stayed the same as the prior week at 12.2mm bbls. Crude storage had and second week with another large increase to 448.0mm bbls. Refinery run rates operated at 85.3%. Jet fuel supplied remained the same as the prior week at 1.4mm bpd. www.eia.gov/petroleum/supply/weekly

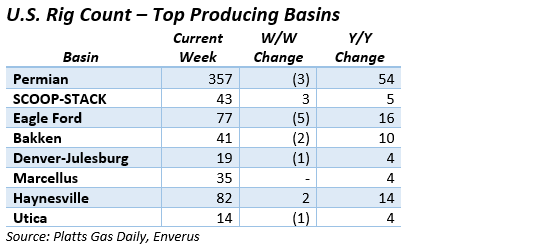

Rig Count Update:

The U.S. O&G rig count fell for the 4th straight week, this time losing a hefty 21 rigs to 855 (worth noting that last week’s total was revised upward by 15). The Permian shed three, the combined SCOOP+STACK gained three and the Eagle Ford was the biggest loser at -5 on the week.

Natural Gas

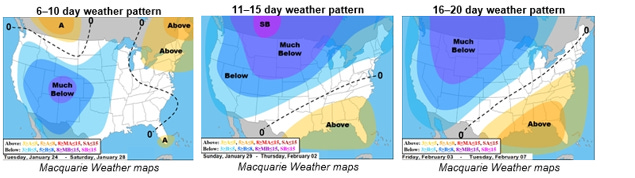

After opening the short week with a rally that saw prices near the $3.80 range, Natural Gas futures had fallen to an 18-month low by mid-week. This morning’s trading had prices in the $3.20-$3.30 range. With current gas production at near record levels and the anticipated winter demand yet to make a strong push, storage levels are nearing the five-year average. News came out this week that Freeport’s LNG facility has suffered yet another delay, adding more angst to an already pressured pricing environment. With analyst predicting the facility restart will occur at the end of February, at the earliest, the seven-month long outage continues to hamper winter demand projections. The longer-term forecast does have more winter type weather projected. This coupled with the ongoing Russian-Ukraine tension could prompt a rise in demand as Russian natural gas flow thru Ukraine is still running 40% below normal. The wait and see continues as prices look to stay with the bears for now.

In the Midcon region, demand is projected to increase. Total demand looks to increase to 23 Bcf/d by week’s end while production activity has increased to 9.3 Bcf/d. According to S&P Global Commodity Insights, month-to-date production for the region is up 10% from the same period last year. With the higher demand and production forecast, spot prices have been mixed. Chicago city-gates is sitting $.12 back at $3.01 while ANR-OK is -$.17 back at $2.94 and NGPL-Midcon comes in -$.34 back at $2.77.

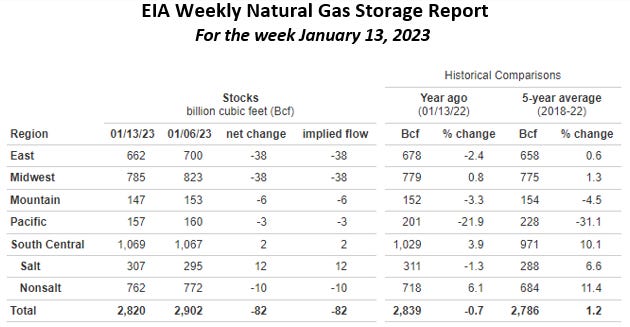

The EIA released storage numbers this morning, coming in at 2,820 Bcf, representing a net -82 Bcf decrease from the previous week. This decrease was slightly more than marketplace expectations of - Bcf decrease. Stocks were 19 Bcf more this time last year and come in 34 Bcf above the 5 yr. historical range of 2,786 Bcf.

Natural Gas Liquids (NGLs)

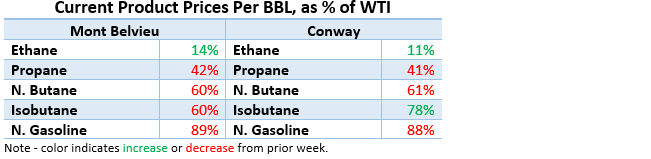

Liquid prices were mixed on the week for both Mont Belvieu and Conway markets: Propanes were both off 12% while Ethane products were higher by 5% and 4%, respectively. All others were down 2-5%, with the exception of Conway isobutane - up 3% WoW. Prices as a % of WTI were mostly lower, with the exception of the few products that saw gains on the week.

ANCOVA DISCLAIMER: The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.