Crude Oil

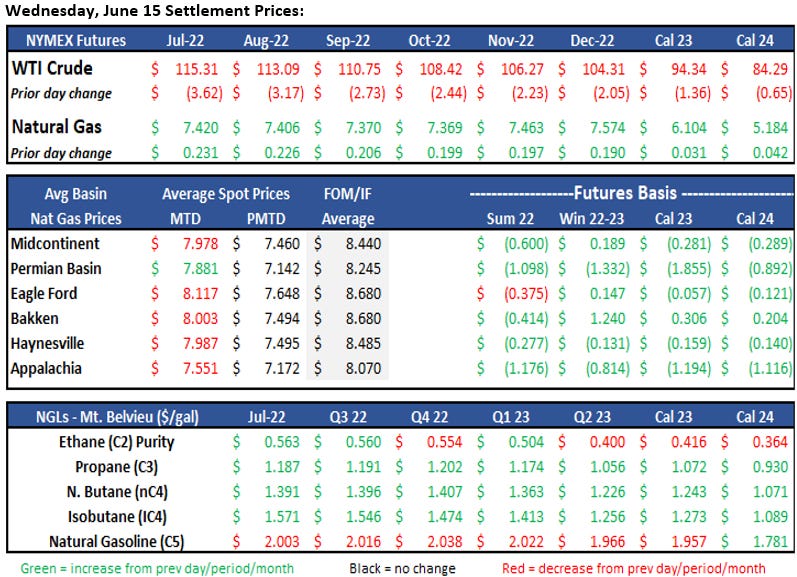

At the time of the newsletter, WTI is trading 5% lower from the prior week at $115.20/bbl following increased interest rates.

On Wednesday, the Federal Reserve raised interest rates three-quarters of a percentage point. WTI fell nearly $5.00/BBL this week leading up to and after the increase of rates.

The U.S. Department of Energy announced on Tuesday plans to sell up to 45mm bbls from the Strategic Petroleum Reserves (SPR). The SPR recently fell to 538mm bbls, the lowest level since 1987.

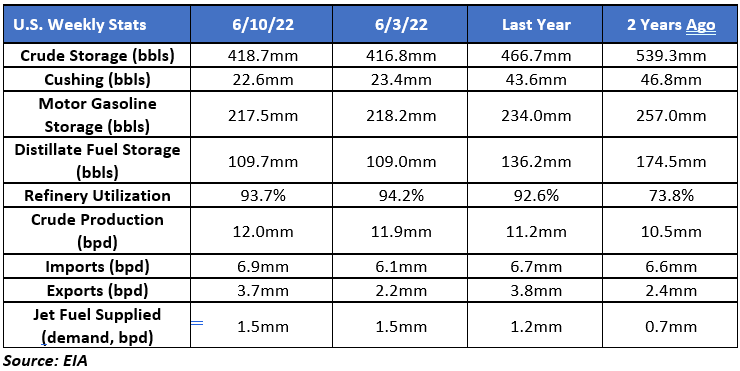

President Biden continues to put pressure on the oil and gas industry to lower prices. This week the refineries ran at 94.2% utilization rate the past week. They continue to run at near maximum rates and it is only a matter of time until there is a disruption that causes the run rates to drop.

OPEC+ is behind 1mm bbls from the May projections. In May, OPEC+ produced less crude than April. OPEC+ announced plans to add 650mm bpd for July and August. The added output would replace Russian oil that is no longer on the market.

The EIA Petroleum Status Report for the week ending June 10th, 2022 reflected a crude inventory increase of 1.9 mm bbls. At 416.8mm bbls, crude inventories remain 14% lower than the five year average. Domestic crude production had a slight increase from the prior week at 12.0mm bbls. Refinery run rates declined slightly this week, but continue to near max rates at 93.7% utilization. Jet fuel supplied remained the same as the prior week at 1.5mm bbls, which is 22% higher than compared to this time last year.

www.eia.gov/petroleum/supply/weekly

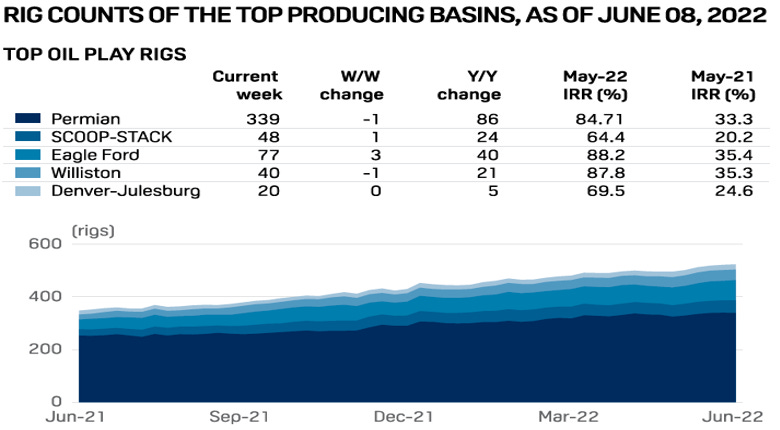

Rig Count Update:

The US oil and gas rig total exploded by 20 on the week to 841, getting back to pre-pandemic levels. Oil rigs accounted for the full gain, adding 21 rigs for a total of 661 with gas rigs falling back one to 280. The bulk of the rigs were added in smaller, non-core plays. The top oil plays netted a gain of two, with the Eagle Ford leading the pack at +3. Permian lost a lone rig, down to 339 with the SCOOP+STACK gaining one to 48 (highest total since late 2019).

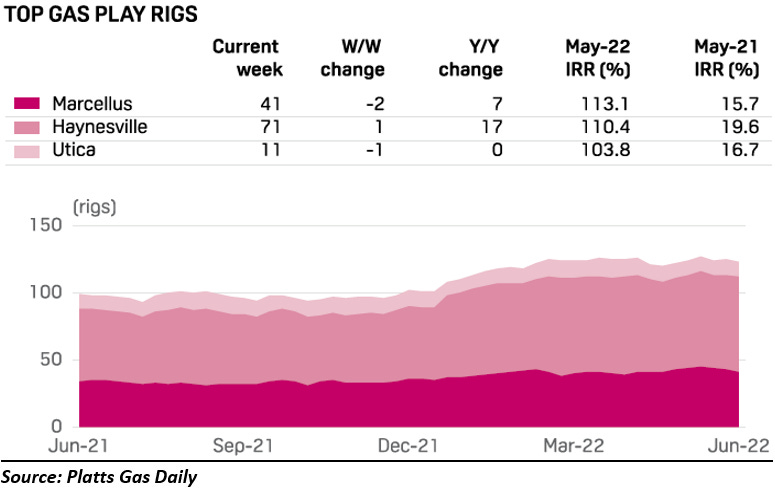

Natural Gas

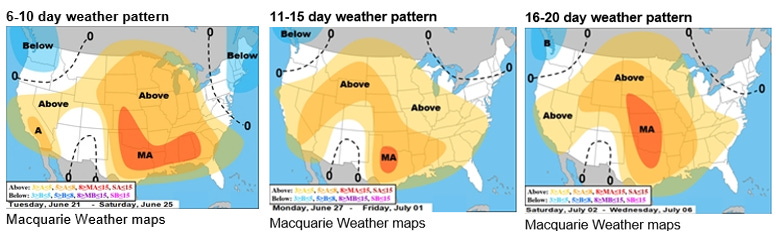

Highlighted by a week of heat waves, delays in LNG facility repairs, European price spikes, and a letter from POTUS, natural gas prices have fluctuated over a $1.50 range this week. After opening at $8.92 on Monday, prices are trading in the mid $7.50 range today. With a heat wave covering more than ½ the US, record power demand is expected over the next few days. The demand pull looks to counter the impact of the delay in repairs to Freeport’s Gulf Coast LNG facility. Initially expected to be offline for about three weeks, it now appears the facility will be down until September with only partial operations through the end of the year. The facility accounts for 20% of US LNG and as news of the extended shutdown traveled this week, US prices saw a 17% slump. European prices on the other hand have surged with the news of the facility’s extended shut down. With supplies reduced, pressure continues to mount as Europe fights to meet demand in its already fragile gas market. Last but certainly not least, President Joe Biden is calling on all US oil refining companies to produce more. In a letter, sent out on Wednesday of this week, companies are being asked to simply “produce more.” With most refineries already operating are over 90% utilization rates, stay tuned for the administration’s plans to ramp up refinery capacity in the near term.

The Midcon region has seen natural gas prices trying to inch back up despite lower demand, higher storage injections and excess supply. Total demand in the region has fallen about 6% with residential and power demand both declining, as forecasted through the end of the week. According to Platts Analytics data, year -to-date supply in the Midcon remains 8% higher than this time in 2021 with storage levels hanging around the 4.2 Bcf level. This week’s prices have ANR-OK in the low $7 range at $7.14 while NGPL-Midcon is sitting similarly at $7.12.

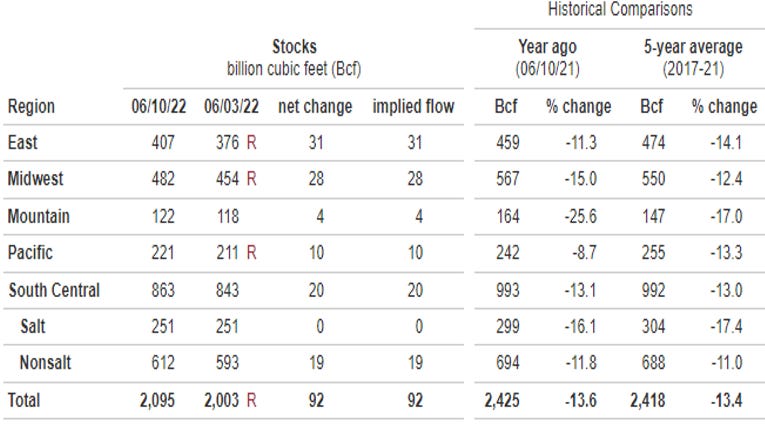

The EIA released storage numbers this morning, coming in at 2,095 Bcf, representing a net +92 Bcf increase from the previous week. This increase was slightly below marketplace expectations +87. Stocks were 330 Bcf higher this time last year, however, this week’s levels are still within the 5 yr. historical range of 2,418 Bcf.

EIA Weekly Natural Gas Storage Report

For the week June 10, 2022

Natural Gas Liquids (NGLs)

All Products across both Mont Belvieu and Conway took a hit from previous week prices. MB Purity Ethane took the smallest hit, down 3% while Conway Ethane took the largest at 17%. Most products across both markets lost at least 10%, while both Propane prices dropped 5%.

Current product prices (% of WTI):

Per the EIA Weekly report released yesterday, US Propane stocks rose for the fifth consecutive week, adding 1.6mm bbls to 51.8mm. Despite the five-week increase, storage is still below last year’s mark of 53.7mm bbls. Propane Demand fell off from the previous week from 1.37mm bpd from 0.84mm. Production remained flat for the second week in a row at 2.4mm bpd.

ANCOVA DISCLAIMER: The information contained in this report is confidential. This report may not, in whole or part, be disclosed, reproduced or distributed to others unless you receive prior written consent from Ancova. The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.

Thank you for sharing this