Wishing all of you a SAFE and HAPPY 4th!!

Crude Oil

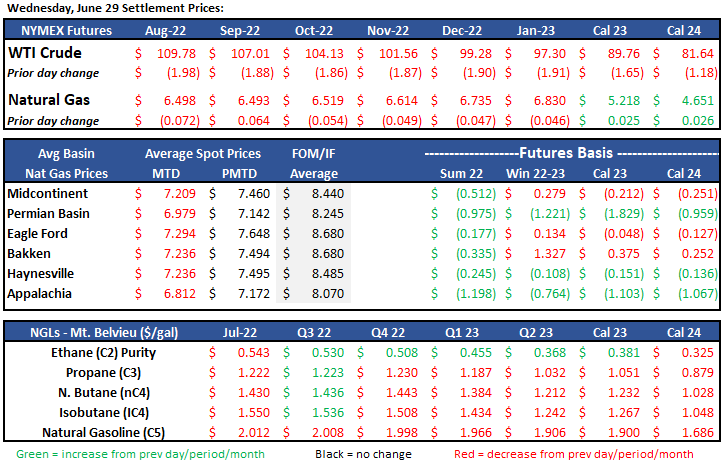

At the time of publication, WTI was trading $3.70 lower to $106.14/bbl.

The U.S. has continued to release oil from the Strategic Reserves. As of June 24th, 67mm bbls has been released leaving the current reserves at 497.9mm bbls, which is the lowest level since 1986. The U.S. plans to release another 100mm bbls by September 2022.

OPEC+ met this week and agreed announced agreed to stick to the previous plans to boost production by 648mm bpd in August.

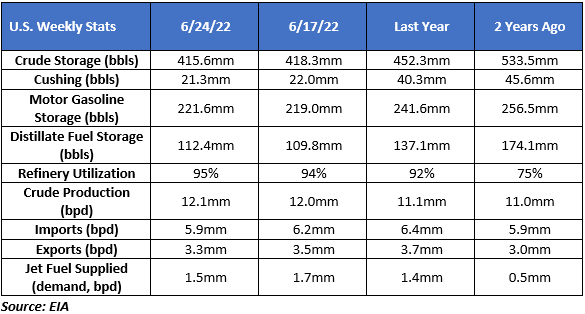

Refineries ran at 95% utilization rate the past week. They continue to run at near maximum rates.

The most recently published Refining Capacity Report by the EIA outlined the decline of refining capacity. Although the US Refiners have been consistently running near max utilization rates, the overall US refining capacity has decreased by 18mm bbls since this time last year. The US has 130 operating refineries today with the capacity to refine just shy of 18mm bbls per day. Current refinery rates are 16mm BBLs per day. Chevron’s CEO said last week, that it is unlikely that any new refineries will be built in the near future give the current political climate.

Iran has drastically increased crude oil exports, doubling from May to June. In May Iran exported 461mm bpd and most recent June exports show 961mm bpd. China has and will continue to be the main buyer of Iran crude. Iran is still under sanctions that President Trump put into place in 2018. However, if sanctions are removed and Iran is able to sell globally, some estimate Iran could quickly ramp up to 500mm bpd of crude exports.

The EIA Petroleum Status Report for the week ending June 24th, 2022 reflected a crude inventory decrease of 2.7mm bbls. At 415.6mm bbls, crude inventories remain 13% lower than the five year average. Domestic crude production had a slight increase from the prior week at 12.1mm bbls. Refinery run rates increased this week and continue to near max rates at 95% utilization. Jet fuel supplied decreased from the prior week at 1.5mm bbls, which is 17% higher than compared to this time last year.

www.eia.gov/petroleum/supply/weekly

Natural Gas

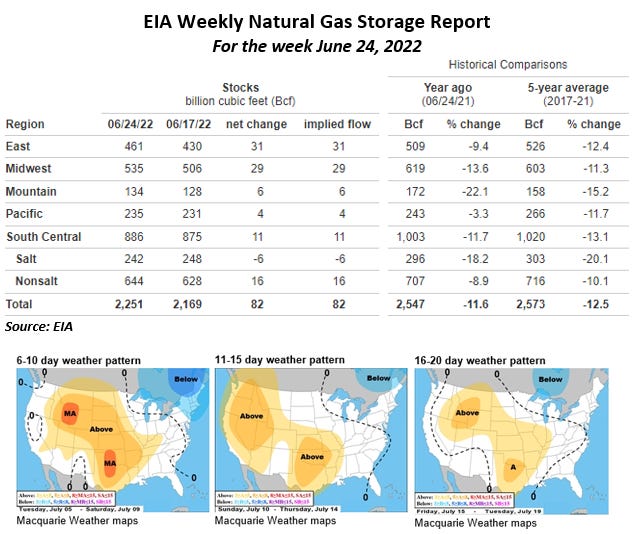

After opening at $6.425, Natural Gas futures took a tumble after storage numbers were released this morning. Prices were trading in the low $6.00 range after a reported storage injection of 82 Bcf. Turning to weather, look for cooling demand to increase over the near term as weather models are showing a hot pattern for most of the southern two-thirds of the US. More gas continues to flow to storage due to the Freeport LNG terminal’s prolonged outage and Russian gas flow to Europe is still in jeopardy. As we move into July and August, the official start of hurricane season, a major weather event would be a potential price driver. However, the price volatility looks to continue as market uncertainty remains and we’ve moved into a bearish market structure for the near term.

Midcon prices are still hovering the mid-$6 range this week, ANR-OK is sitting $0.33 back at $6.34 while NGPL-Midcon is $0.36 back at $6.31. Month to date demand in the region is still higher than this time last year, averaging 15.09 Bcf/d, while month to date supply has reached 20.88 Bcf/d, which comes in 9% higher than last year. According to S&P Global commodity Insights date, production in the Central US is 9.05 Bcf which is above the June 2021 mark of 8.92 Bcf/d.

The EIA released storage numbers this morning, coming in at 2,251 Bcf, representing a net +82 Bcf increase from the previous week. This increase was above marketplace expectations +71. Stocks were 296 Bcf higher this time last year, however, this week’s levels are still within the 5 yr. historical range of 2,573 Bcf.

Natural Gas Liquids (NGLs)

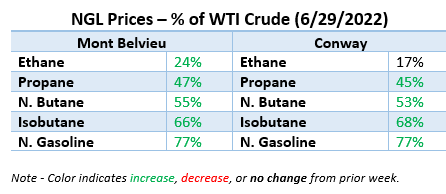

All Mont Belvieu prices saw an increase from same period last week, with N. Gasoline showing the largest at 7%. All other product increases ranged between 4-6%. Same could have been said for Conway products had Ethane not dropped 4%. Isobutanes led with an 11% increase; others saw increases between 2-6%.

ANCOVA DISCLAIMER: This report may not, in whole or part, be disclosed, reproduced or distributed to others unless you receive prior written consent from Ancova. The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.