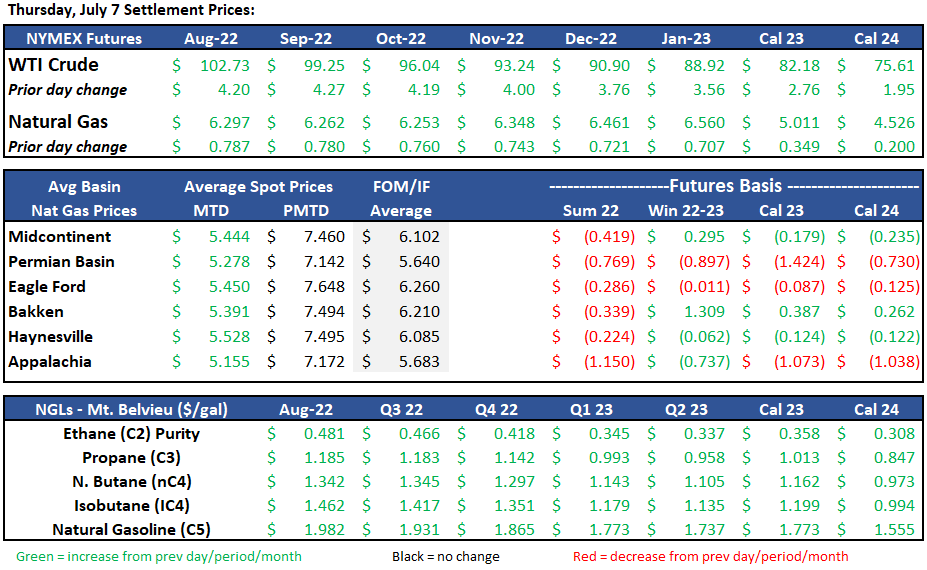

Crude Oil

The prompt month crude contract closed at $104.80/bbl this afternoon, up ~2% on the day but down nearly 4% on the week overall. Tuesday saw the most significant movement, opening the week at $108.80 but settling below $100 to $99.50/bbl for the first time since mid-May. The rising dollar, expectation that interest rates will continue to rise, and the idea that demand post-Independence day will soften caused a sudden sell-off. A fairly large crude inventory build and imports kept the late week rally in check.

Many are still forecasting high crude prices. Citi is forecasting Brent to be $113/ bbl for the remainder of 2022. Barclay is forecasting $111/bbl through 2023.

The U.S. has continued to release oil from the Strategic Reserves. As of June 24th, 67mm bbls has been released leaving the current reserves at 497.9mm bbls, which is the lowest since 1986. The U.S. plans to release another 100mm bbls by September.

OPEC+ met last week week and agreed announced agreed to stick to the previous plans to boost production by 648mm bbls per day in August.

Iran has drastically increased crude oil exports, doubling from May to June. In May Iran exported 461mm bbls per day and most recent June exports show 961 mm bbls per day. China has and will continue to be the main buyer of Iran crude. Iran is still under sanctions that President Trump put into place in 2018. However, if sanctions are removed and Iran is able to sell globally, some estimate Iran could quickly ramp up to 500mm bbls per day of crude exports.

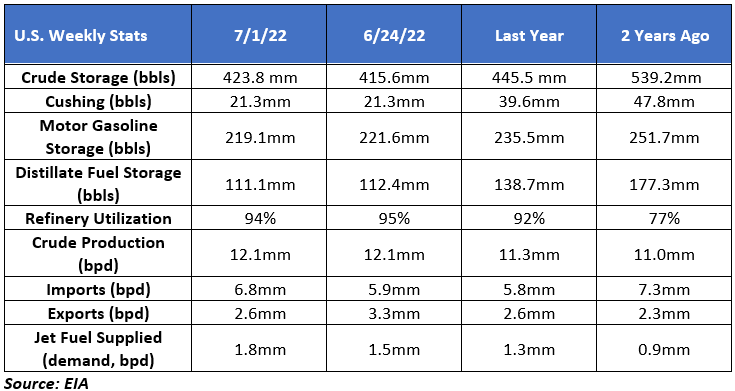

The EIA Petroleum Status Report for the week ending July 1st, 2022 reflected a crude inventory increase of 8.2 mm bbls. Domestic crude production stayed the same as the prior week at 12.1mm bbls. Refinery run rates increased this week and continue to near max rates at 94% utilization. Jet fuel supplied increased from the prior week at 1.8mm bbls.

www.eia.gov/petroleum/supply/weekly

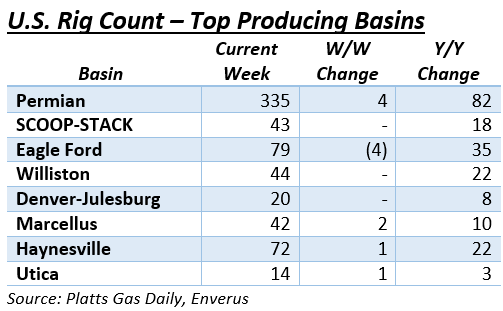

Rig Count Update:

The combined US count fell off two on the week to 845, with the Permian the biggest gain (+4) and the Eagle Ford the biggest loser (-4). All other oil basins stayed flat, while the major gas plays added a net four. The overall rig total is up 139, or 20%, so far this year. The SCOOP-STACK was idle at 43. Although analysts expect the rig count to continue its upward trend this year, they also cite a tight labor market, inflation, and supply chain challenges as main factors in the count slowing.

Natural Gas

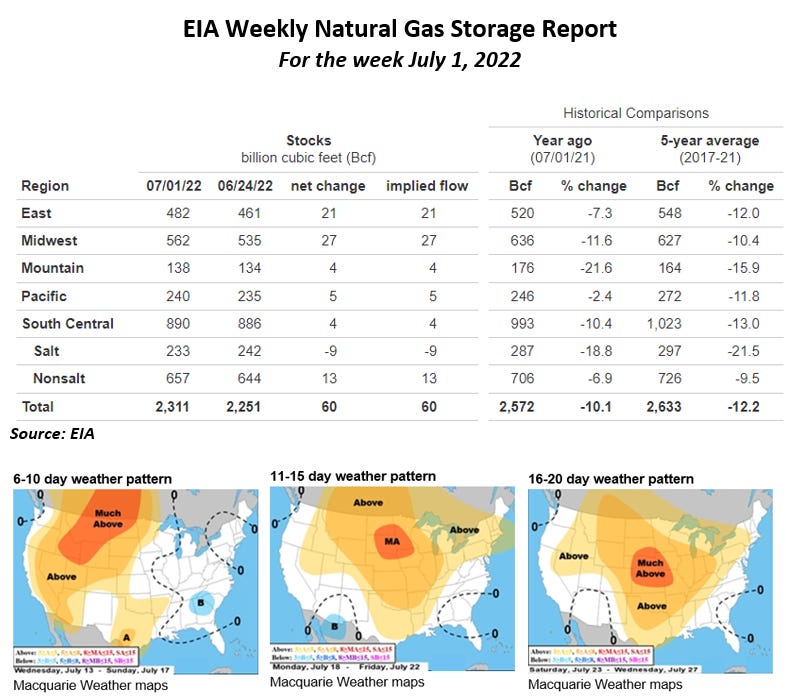

Several newsworthy events this week as Natural Gas futures have been on the upward tick the past few days, bouncing back above the $6 mark. Freeport’s Texas LNG facility is looking at a Q4 time frame for re-opening and this may keep prices near a $6 cap for the near term. Half of Norway’s gas production was nearly derailed this week as a labor dispute ensued on Monday. Had the government not stepped in and halted the strike, the nation was facing a 13% output decrease, just as they were ramping up to meet the urgent European gas demand. Germany is looking at Canada to release a Nord Stream pipeline part that has been stranded and waiting on repairs since the Russian invasion of Ukraine. With the pipeline operating at 40% capacity, the part should help increase flows and de-escalate the gas standoff between Russia and Germany. The weather forecast has most of the US looking at above average temps for the next few days which should factor an increase in cooling demand.

Midcon prices continued a downward trend this week but rebounded nicely yesterday and are now sitting above the mid-$5 range. ANR-OK comes in $.15 off Henry Hub at $5.71 while NGPL-Midcon is only $.06 back at $5.80. While total demand in the Central US has dropped to 14 Bcf/d, the lowest we’ve seen in the past 3 weeks, month-to-date demand is still coming in 6% higher than we saw in July 2021. Residential-commercial demand dipped to its lowest levels since August 2019, coming in right above 7 Bcf/d. With storage in the Midcon seeing a 9% increase yesterday, the month-to-date average is 17% higher than in July 2021 levels, while the year-to-date levels are still 15% lower than last year (S&P Global commodity Insights.)

The EIA released storage numbers this morning, coming in at 2,311 Bcf, representing a net +60 Bcf increase from the previous week. This increase was above marketplace expectations +55. Stocks were 261 Bcf higher this time last year, however, this week’s levels are still within the 5 yr. historical range of 2,633 Bcf.

Natural Gas Liquids (NGLs)

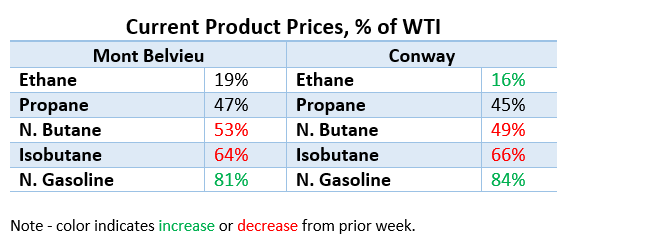

All products in Mont Belvieu and Conway, with the exception of Conway Ethane (+2%), were losers on the week. Natural Gasoline in both markets were off slightly at 1%, while Isobutanes were off 11% and 9%, respectively. N. Butanes also took a moderate hit at 7% and 9%, respectively. Propane in both were off 4%. Most notably, since 6/28, Month Belvieu Purity Ethane has dropped from ~$0.66/gal to $0.485/gal, a near 27% fallout. In line with Nat Gas and Crude futures, the NGL strip continues its backwardation, dropping off significantly in 2023 and 2024.

ANCOVA DISCLAIMER: This report may not, in whole or part, be disclosed, reproduced or distributed to others unless you receive prior written consent from Ancova. The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.