Pricing

Crude Oil

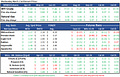

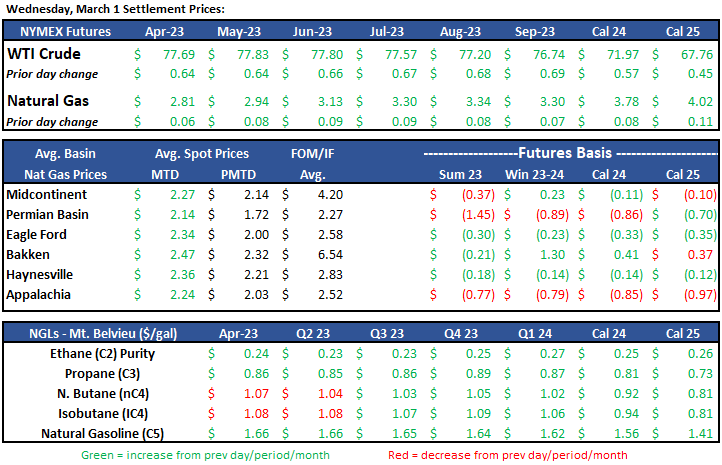

The prompt month crude contract has traded in a fairly tight range this week, opening at $76.42 and slowly edging higher, currently up $0.42 in early afternoon trading today to $78.32. Prices are hanging in there despite another build in U.S. storage (10th consecutive week!), including the NYMEX delivery hub in Cushing. The Strategic Petroleum Reserve (SPR) has been a significant contributor for previous builds/current storage levels, but it’s important to note that it’ll have to be refilled at some point in time. Asian demand along with record high U.S. exports appear to be supporting the recent uptick in prices. According to a Reuter’s report, Chinese manufacturing activity in February rose at the fastest pace in more than a decade, reinforcing expectations of a strong economic rebound for the world’s largest oil importer. Couple this with last week’s report of ten supertankers hauling crude back to Asia and it’s showing real corroboration that China is in fact lifting Covid restrictions, which is long overdue in the opinion of many.

www.eia.gov/petroleum/supply/weekly

Rig Count Update

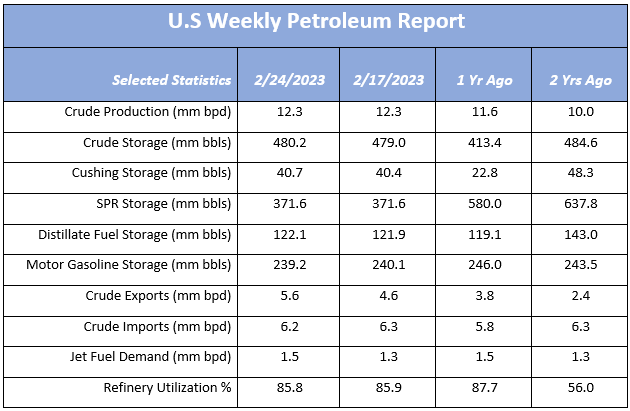

The U.S. O&G rig count dropped off again, losing 11 on the week down to 857. Oil rigs took the biggest hit, falling 13 to 659 with nat gas rigs picking up two rigs and currently sitting at 198. Overall, the major oil plays only netted a one rig drop, with the Permian adding two and the DJ Basin dropping two. The SCOOP+STACK fell one to 42 active. Not much change in the gas heavy basins - the Utica the biggest mover at a net two rig decrease. The Marcellus picked up a sole rig to 34. The overall count has steadily declined since mid-Nov when it peaked at 901.

Natural Gas

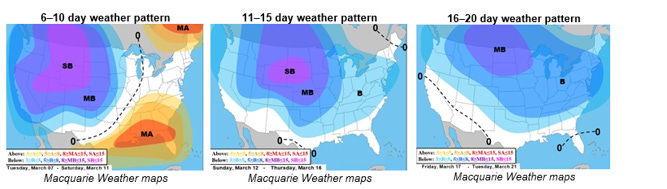

Natural Gas prices have seen an upswing this week. After opening at $2.65, cooling temps and falling production numbers have supported the rally of the reversal this week. With the 8–14 day forecast turning colder for much of the US, a strong pull on demand is expected. US production fell over 2% last month as the rig count dropped close to a nine-month low. Freeport’s LNG facility continues to increase output with the second train coming back online. This is welcome news as the European weather forecast looks to bring in temps much colder than the United States. As of February, the amount of gas flowing from US LNG export plants is near the monthly record of 12.9 Bcf/d set back in March of last year. Keep an eye on April natural gas contracts as late winter demand pulls look to flip the script back to the bulls.

In the Midcon region, spot natural gas prices are rising as forecasted demand looks to increase substantially. Chicago city-gate increased $0.10 to $2.50/MMBtu with ANR-OK following suit at $2.50, ONEOK at $2.20 and Panhandle at $2.30. With temps forecasted to drop in the Midcon market area, Residential-commercial demand was predicted to grow by 2.2 Bcf to 14.2 Bcf/d as power demand looked to cover the remaining 178 MMcf/d increase according to S&P Global Commodity Insights. The forwards market, on the other hand, saw prices drop for the second day as Chicago city-gates fell to a $.05 premium to Henry Hub while ANR-OK and NGPL Midcontinent were sitting at $2.68 and $2.54.

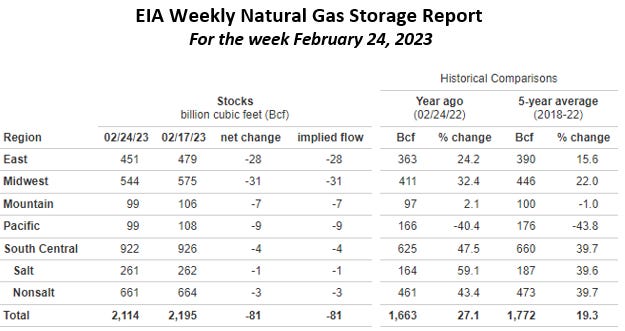

The EIA released storage numbers this morning, coming in at 2,114 Bcf, representing a net -81 Bcf decrease from the previous week. This decrease was slightly more than marketplace expectations of –78 Bcf decrease. Stocks were 451 Bcf less this time last year and come in 342 Bcf above the 5 yr. historical range of 1,772 Bcf.

Natural Gas Liquids (NGLs)

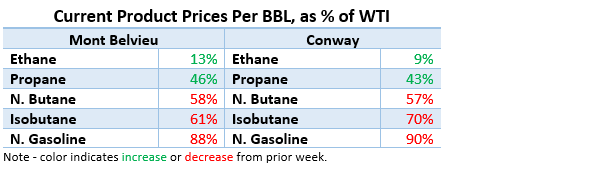

April product prices in both Mont Belvieu and Conway were mixed on the week. Ethane was 6% and 3% higher, respectively as well as Propane at 3% and 2%, respectively. The heavies were flat and both N. Butane and Isobutane were all 2-9% lower compared to same period last week.

ANCOVA DISCLAIMER: The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.