Crude Oil

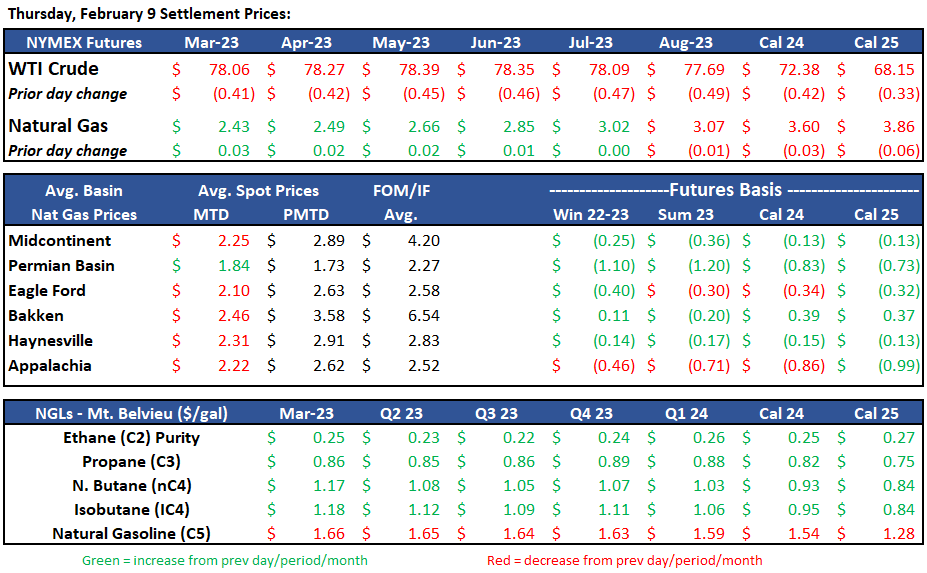

At the time of the report (2/10, 9:50 am) WTI was trading $1.28 higher to $79.34/bbl as Russia announced this morning that they would be cutting production by 500K bpd due to growing pressure from price caps and embargoes. This is the first major voluntary supply disruption in 2023 and are expected to begin next month. Weekly offsets to WTI include the most recent EIA report, which reflected a third consecutive week of crude inventory build.

Analysts have been forecasting increased Chinese crude demand. However, in recent weeks Chinese demand has not met expectations. Lower crude demand was likely due to interest rate concerns and uncertainty of China’s post Covid rebound. If China demand does rebound, current OPEC+ production levels would not meet demand.

With increased demand coming from China, Japan and India, world crude demand hit a 9 month high at 1.7 million bopd. November global demand matched pre Covid demand, while November global production is ~3% below pre Covid.

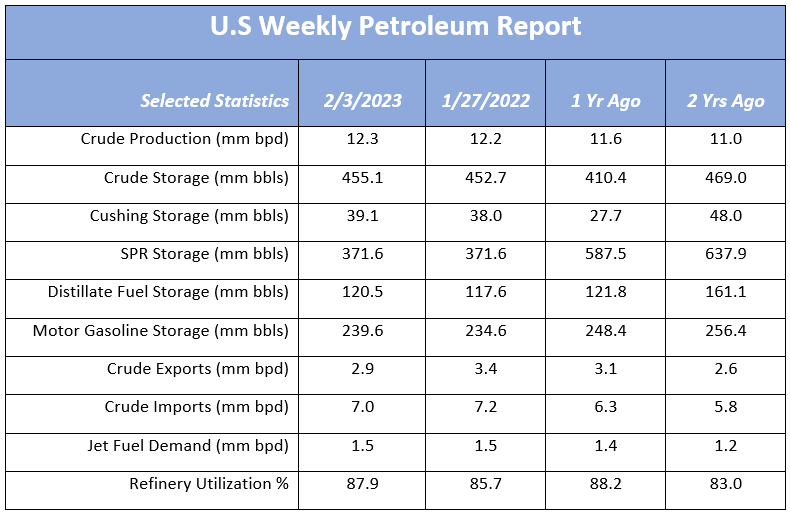

The EIA Petroleum Status Report for the week ending February 3rd, 2023 was released earlier today, production had a slight increase from the week prior at 12.3mm bbls. Crude storage continues to increase at is currently 455.1mm bbls. Refinery run rates operated at 87.9%. Jet fuel supplied remained the same as the prior week at 1.5mm bpd. Both crude import and exports were down from the prior week.

www.eia.gov/petroleum/supply/weekly

Rig Count Update:

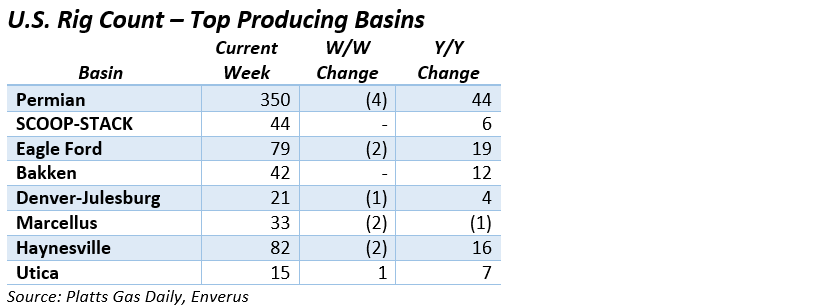

The US oil and gas rig count continues to decline, dropping another dozen rigs on the week, with the Permian leading all basins with 4 rig losses. The SCOOP+STACK combined play remained unchanged while the Utica was the only major basin to post a gain at 1. With the weekly decline, the rig count dropped back down to September 2022 levels.

Natural Gas

Natural Gas futures have hung around in the mid-$2 range most of the week amid warmer weather and decreases in demand. This week paints an entirely different picture from six months ago, when the number of drilling rigs jumped 48% and thoughts of European gas supply in jeopardy had prices cranking past $9. The drop in gas prices has also slowed merger & acquisition activity and looks to slow drilling activity further. On a positive note, Freeport’s LNG facility is now targeting a March 2023 restart date. With 2.1 BCF of processing capacity, a push in gas prices is anticipated as most of the cargo looks to head to Europe and should lessen fears of the possibility of storage exceeding its 4.3 Tcf limit, according to Reuters.

With expected increases in supply and demand in the Midcon region, spot natural gas prices resulted in a mid-week bump. NGPL Midcontinent increased by almost $.20 to $2.15, with ANR OK sits at $2.32. Total demand was expected to rise to nearly 22.9 Bcf with the majority coming from a 1 Bcf/d increase in commercial demand. Month-to-date total production has averaged 9.1 Bcf/d, a 15% increase for the same period last year, while month-to-date inflows have decreased 5% in comparison, according to S&P Global Commodity Insights. In the forward’s market, Chicago city-gates sits at a $.08 premium to Henry Hub, while ANR-OK is -$.10 back at $2.48 and NGPL-Midcon comes in -$.32 back at $2.26.

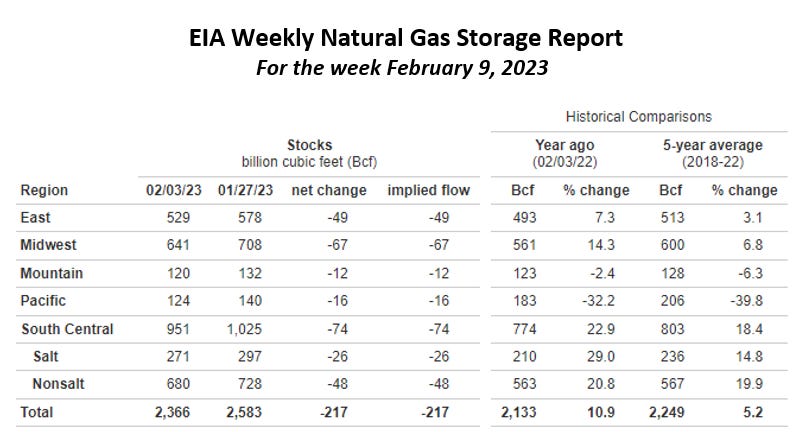

The EIA released storage numbers this morning, coming in at 2,366 Bcf, representing a net -217 Bcf decrease from the previous week. This decrease was slightly more than marketplace expectations of –195 Bcf decrease. Stocks were 233 Bcf less this time last year and come in 117 Bcf above the 5 yr. historical range of 2,249 Bcf.

ANCOVA DISCLAIMER: The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.