Ancova Markets Update

Crude Oil

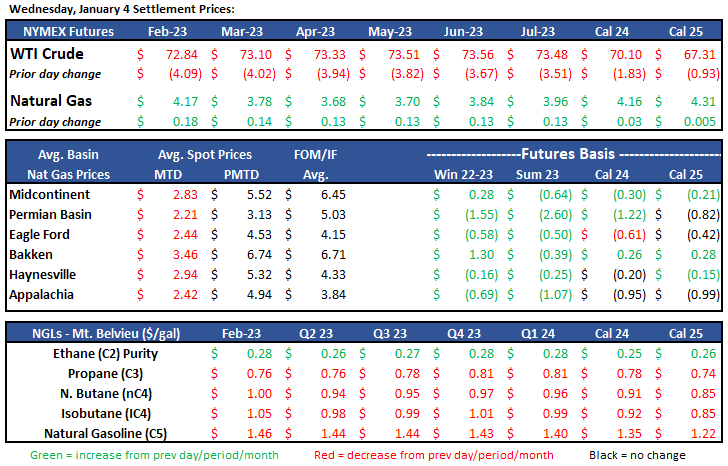

WTI has steadily declined since the beginning of the year, with a modest increase today, at the time of the report WTI is trading at $74.36/bbl. The most recent EIA report reflects increased production and increased inventory while refinery run rates are significantly lower at 79% due to the winter storm.

December production from OPEC+ shows an increase in production month over month, but they are still not meeting the previously announced production quotas. Shockingly, Nigeria announced the discovery of an illegal underwater 2.5 mile pipeline theft operation that has been operating for 9 years.

Due to the Russian price cap, Russia is expected to decrease output by 1mm BOPD starting in February.

The EIA Petroleum Status Report for the week ending December 30th, 2022 was released on today, production had a minor increase from the prior week at 12.1mm bbls. Crude storage also increased slightly to 420.6mm bbls. Refinery run rates have dropped to 79.6%, the lowest since March 2021, due to winter storms. This is due to the winter storm. Jet fuel supplied was lower than the prior weeks at 1.4mm bpd.

www.eia.gov/petroleum/supply/weekly

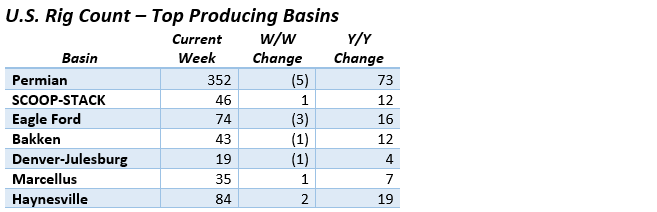

Rig Count Update:

The U.S. O&G rig count fell for the 3rd straight week, falling another seven during the last week of 2022. The Permian accounted for the majority of the losses, losing five rigs, with the Eagle Ford close behind with three. The combined SCOOP+STACK play added a lone rig and now sits at 46. The Haynesville Shale gained two to 84 and to levels not seen in a decade. The sluggish rig moves as of late have not been a surprise to many analysts, who predicted year-end declines due to labor, equipment, and rig and frac crew shortages and longer lead times.

Natural Gas

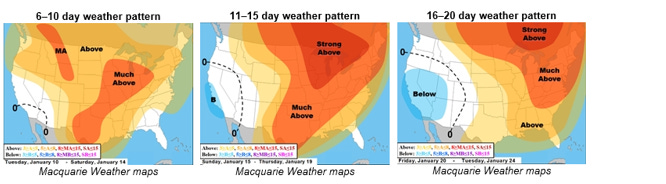

Natural Gas futures have taken a freefall this week after beginning the post-holiday trading session Tuesday near $4.40 and falling as low as $3.82 this morning. Weather and demand still tell the story. With spring-like temps and milder weather showing up in the longer-term forecasts for both the US & Europe, the market is doing its best to bounce back from the selling frenzy earlier in the week. While Europe is not out of the woods just yet, near-term supply concerns look to have eased. With the first US LNG tanker arriving earlier this week, two coal firing plants added to the mix and Russian gas supplies still flowing, the European supply-demand balance appears to have leveled. It remains unknown how long Russia will continue supplying gas, and as the war in Ukraine drags on, any military escalation or retaliation could have a major impact on supplies in an already volatile trading environment. Any late-winter demand increase along with a forecasted hotter summer could be a driving force in the near term but for now the market looks to stay with the bears.

In the Midcon region, supply and demand have both been on the rise. Supply in the Midcontinent was estimated to grow 3% to 22.1 Bcf, bringing the monthly average 3% higher than the same time last year. An average temp drop of 30 degrees took demand upwards as well with residential-commercial demand increasing to 19.9 Bcf/d, an increase of 2.3 Bcf/d, according to S&P Global Commodity Insights data. Following the demand increase, spot prices increased across the board. Chicago city-gates saw a $0.10 increase, topping $3.45, while ONEOK and Southern Star saw bumps coming in at $3.30 and $3.25 respectively while ANR-OK lands at $3.47 and NGPL-Midcon at $0.71.

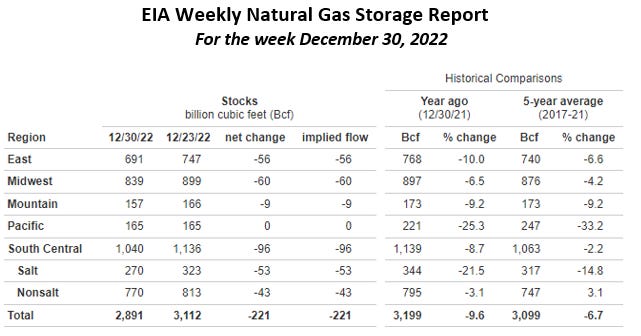

The EIA released storage numbers this morning, coming in at 2,891 Bcf, representing a net -221 Bcf decrease from the previous week. This decrease was slightly less than marketplace expectations of -255. Stocks were 308 Bcf more this time last year and come in 208 Bcf below the 5 yr. historical range of 3,099 Bcf.

Natural Gas Liquids (NGLs)

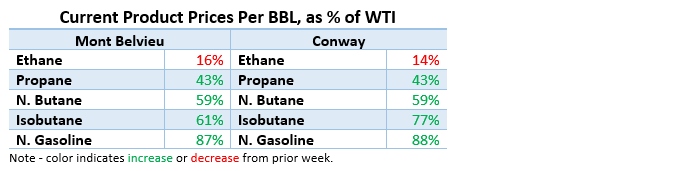

Ethane products in both Mont Belvieu and Conway took decent hits from a week ago, down 8% and 14%, respectively. MB N. Gasoline and Conway Propane were both off a percent. All other products were up on the week, ranging from 2% (Conway N. Gasoline) to 8% (MB Isobutane). Products as a percentage of WTI all increased (with exception of Ethane), as crude has fallen on the week and currently sitting in the low $70s range.

ANCOVA DISCLAIMER: The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.