We want to start this week’s newsletter by saying thanks to all the men and women working out in the oilfield this week and keeping Americans safe and warm. These people are the ones that make the modern world work, and without them many of us would be freezing over the holidays.

This Christmas morning when you are opening presents with your family make sure to give some thanks to those people who are out in the field keeping the vital energy flowing to our homes.

Energy Market Update

Crude Oil

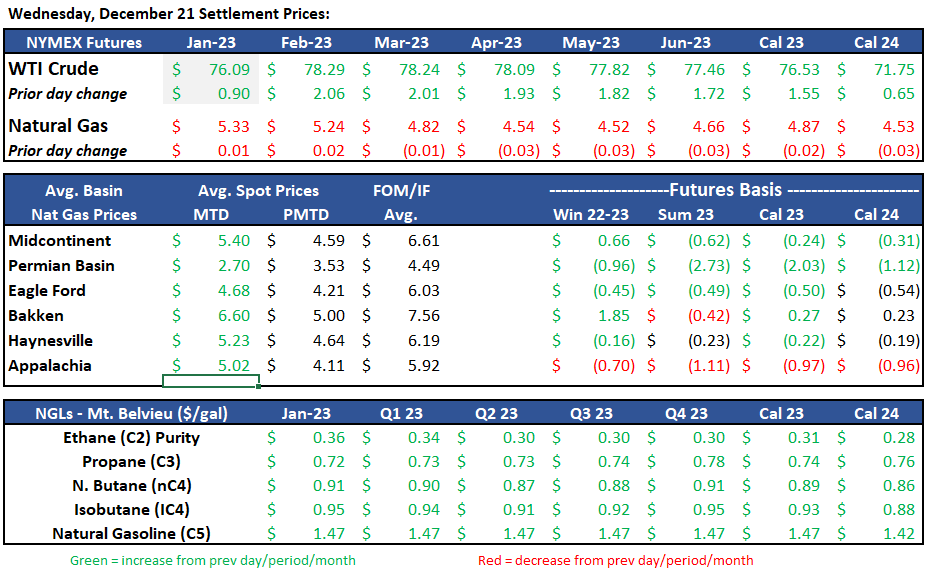

At the time of the report WTI is trading at $78.03/bbl. WTI had a modest $2 increase from the beginning of the week after the EIA reported a second week of inventory draws and much of the U.S. will be impacted by a winter storm.

Crude prices seems low to moderate considering the short term supply and demand dynamics. For supply, OPEC+ has once again missed the production quota by 1.8mm bpd. This continues to show that OPEC+ is at the maximum production levels. U.S. production has plateaued at 12.1mm bpd and will not fill the short term supply gap. Russian bbls are largely off the market for those who abide by the price cap. For demand, the U.S. has announced plans to refill the SPR and will buy 200mm bbls by end of year.

Exxon and Shell have announced they will not hire tankers that previously hauled Russian crude or have any connection to Russia. The European Union passed the Russian crude price cap at $60/bbl and was implemented December 5th.

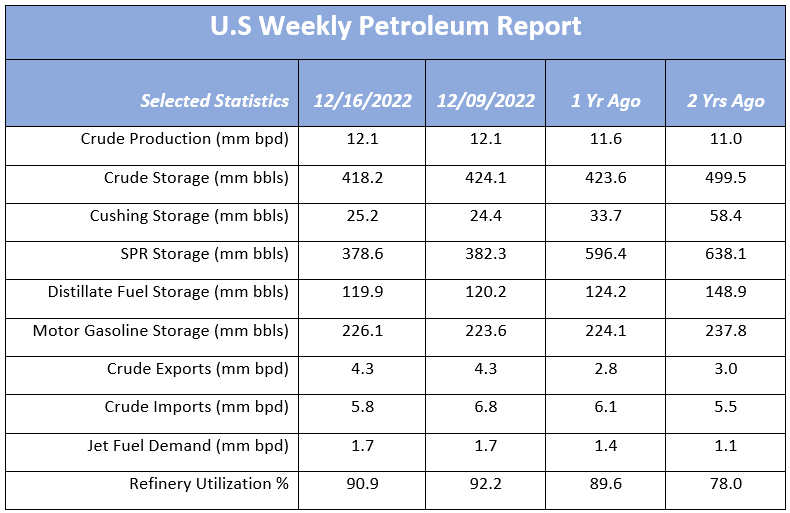

The EIA Petroleum Status Report for the week ending December 16th, 2022 was released on Wednesday, production stayed the same as the prior week at 12.1mm bbls. Crude storage had a draw of 5.9mm bbls to 418.2mm bbls. Refinery run rates are still running high but had a reduction from the prior week down to 90.9%. Jet fuel supplied remained the same as the prior week at 1.7mm bpd.

www.eia.gov/petroleum/supply/weekly

Natural Gas

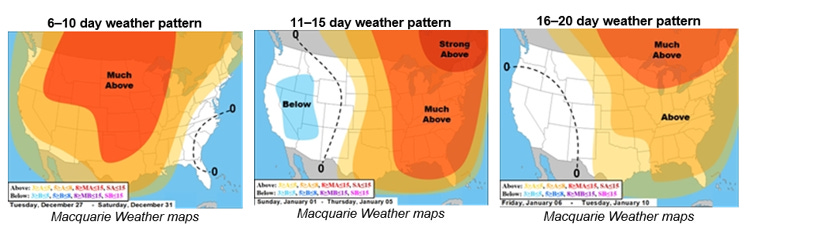

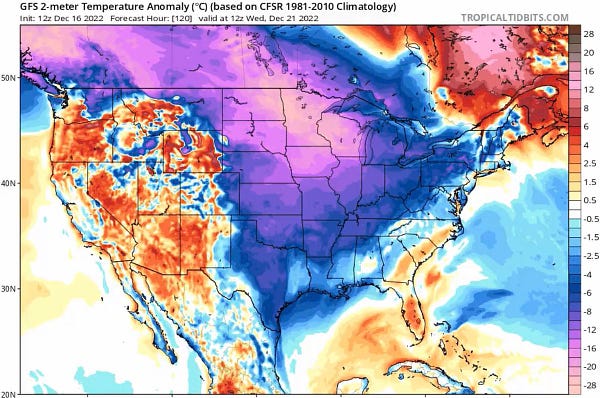

Natural gas futures began the week over the $6 mark but have trended downward most of the week. The European Union gas price cap tops newsworthy items. Agreed upon Monday, the cap is the latest attempt to lower gas prices after Russia cut off most deliveries into Europe. The cap kicks in if the price exceeds 180 euros ($191.11) for three days. The cap has raised eyebrows as the ICE exchange fears the impact on forward price business. While EU countries can still bid for gas in the global market, many unknowns under the agreement will add to an already volatile market. Futures were uplifted yesterday ahead of the artic blast that’s hitting the central US this morning. While the cold blast will draw on storage, the longer-term forecast has a warming trend headed for most of the US. Freeport TX LNG facility looks to target a mid-January opening. With futures falling nearly 25% over the past two weeks, January looks like it will stay with the bears.

In the Midcon region, spot prices took a drastic uptick yesterday with the forecasted arctic blast moving in. Both Southern Star and Upper Midwest Northern saw surges of more than $24, marking the highest level since the 2/21 winter freeze. Demand is expected to increase over 3 Bcf to 32 Bcf, according to S&P Global Commodity Insights, with most of the pull coming from the Midcon producing area. Production was also expected to be lower on the day, contributing to the move up in prices. With a daily production decline of over 2%, the decrease brings the total supply to just over 20 Bcf/d and keeps the prices bullish.

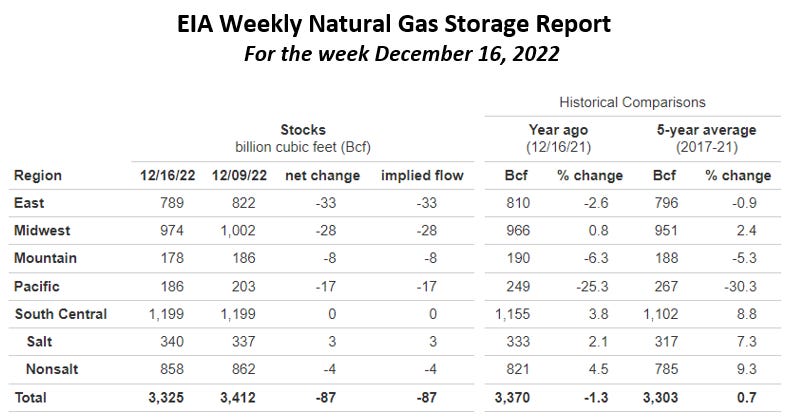

The EIA released storage numbers this morning, coming in at 3,325 Bcf, representing a net -87 Bcf decrease from the previous week. This decrease was slightly less than marketplace expectations of -89. Stocks were 45 Bcf more this time last year, however, this week’s levels are still within the 5 yr. historical range of 3,303 Bcf.

ANCOVA DISCLAIMER: The opinions expressed in this report are based on information which Ancova believes is reliable; however, Ancova does not represent or warrant its accuracy. These opinions represent the views of Ancova as of the date of this report. These opinions may be subject to change without notice and Ancova will not be responsible for any consequences associated with reliance on any statement or opinion contained in this report. This report should not be considered as an offer or solicitation to buy or sell any securities.